Maximising Long-Term Gains: The Power of Compounding Returns on Equities

Investing in a portfolio of high-quality compounders – well managed companies with sustainably high returns on operating capital – can result in strong returns and the potential to outperform traditional equity indices, according to Bruno Paulson, portfolio manager for Morgan Stanley Global Sustain Fund and managing director of Morgan Stanley Investment Management’s International Equity team.

“We’re well-known advocates for a long-term approach to high quality investing. The secret to compounding is steady growth at sustainably high returns on operating capital over the long term, which can compound shareholder wealth over the long term, something lower quality companies are unable to do,” Mr Paulson said.

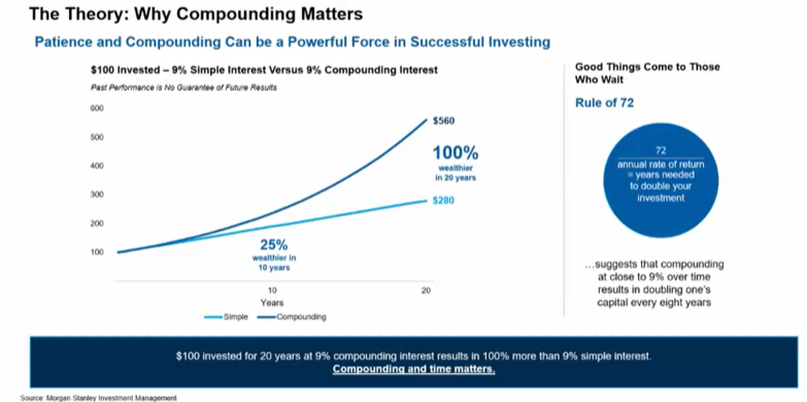

The chart below illustrates the power of compounding, comparing an initial investment of $100 receiving 9 per cent simple interest versus 9 per cent compounding interest over 10 years. As the chart demonstrates, compound interest results in the doubling of capital every eight years, with returns growing dramatically over time.

As Mr Paulson explains, the International Equity team looks for the companies in their global portfolios to be able to continue to compound at around 10 per cent. For a typical company in the portfolio this might be achieved by revenues growing reliably at 5 to 6 per cent across the economic cycle, incremental improvements in margins adding another 1 per cent, and with a 4 per cent free cash flow yield, helped by the near 100 per cent free cash flow conversion, completing the picture.

In rough economic conditions, can the market match this compounding ability? The team is not convinced. “That is the worry right now, that after 15 years without a recession, barring the brief interregnum of COVID, trickier times may be on the way, though signs of an imminent US recession are fading” notes Mr Paulson.

While 2023 was the story of the Magnificent Seven in the US, things have moved on in 2024. “We now have talk of the ‘Fabulous Four’, but it is really the ‘Omnivorous One’ – the American graphics processing unit and chip systems company Nvidia, which is up another 150 per cent in the first half of 2024 as reported by Forbes and at a US$3.09 trillion market capitalisation, according to Bloomberg”.

A combination of ebullient and concentrated markets makes for a challenging investment environment, however, the team’s response is to think in absolute terms and look to compound over the long run. “We want to avoid the permanent destruction of capital, which we would argue is just as important to investors as the chance to earn outsized investment returns.”

Ultimately, the team believes long-term investors benefit from investing in high quality equities that can stand the test of time.

More information on the Morgan Stanley strategy available in Australia, visit the Morgan Stanley Global Sustain Fund page or register for the webinar with Bruno Paulson on 31 July at 11am.

SG Hiscock & Company has prepared this article for general information purposes only. It does not contain investment recommendations nor provide investment advice. Neither SG Hiscock & Company nor its related entities, directors or officers guarantees the performance of, or the repayment of capital or income invested in the Funds. Past performance is not necessarily indicative of future performance. Professional investment advice can help you determine your tolerance to risk as well as your need to attain a particular return on your investment. We strongly encourage you to obtain detailed professional advice and to read the relevant Product Disclosure Statement and Target Market Determination, if appropriate, in full before making an investment decision.

SG Hiscock & Company publishes information on this platform that to the best of its knowledge is current at the time and is not liable for any direct or indirect losses attributable to omissions for the website, information being out of date, inaccurate, incomplete or deficient in any other way. Investors and their advisers should make their own enquiries before making investment decisions.