Emerging Companies Insights: US macroeconomic developments

By Rory Hunter

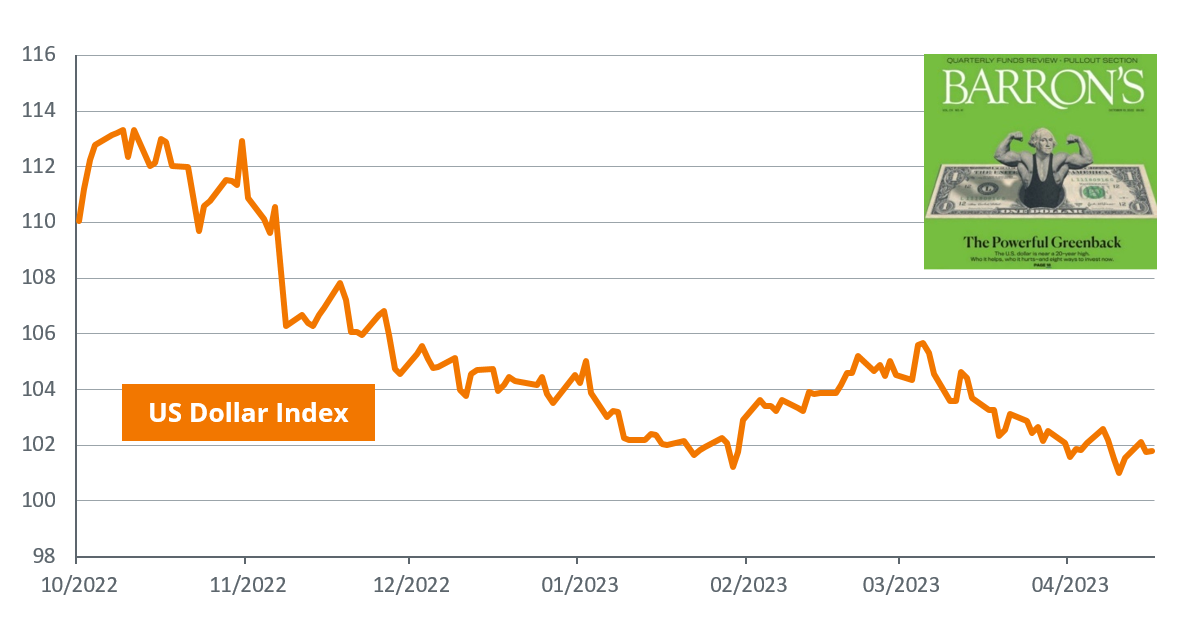

It is intriguing to look back at our previous insights publications with the benefit of more recent macro data points to get an understanding of how expected developments have come to pass. In October 2022 we noted that we like to utilise simple observations, such as covers of widely read financial publications, to complement our sentiment indicator models.

The publication we pointed to in this piece was the October 2022 edition of Barron’s titled “The Powerful Greenback”. Around the time that this was published, the US Dollar Index peaked at 113 on 19th August and since then a significant drawdown has ensued with the index now trading at just under 102.

Barron’s October edition front cover and a chart of the US Dollar Index – note the significant drawdown which commenced in late October 2022

Figure 1: US Dollar Index Source: Barron’s, Bloomberg, SG Hiscock & Company

It is well understood that precious metals perform well when the below listed conditions are playing out:

- Expectations of a deteriorating economic environment, particularly in the US

- Decreasing real interest rates (being nominal rates net of inflation expectations)

- Heightened geopolitical tensions

- A weakening US Dollar.

Ray Dalio’s book, “Principles for Dealing with the Changing World Order” is a great read considering current global developments and geopolitical tensions

“We are on the right side of history — with our commitment to democracy, with our resistance to aggression in Russia. But it’s looking a bit lonely on the right side of history, as those who seem much less on the right side of history are increasingly banding together in a whole range of structures.”

Lawrence Summers, Former US Treasury Secretary

“Big conflicts between countries are arising from the rise of countries (now most importantly China) that are becoming roughly powerful enough to be able to challenge the existing world powers (most importantly the US) and the world order (most importantly the American world order).”

Ray Dalio, Chief Investment Officer, Bridgewater Associates

Continuing with this theme, ECB president, Christine Lagarde recently made a speech at the Council on Foreign Relations stating that the fight against inflation will take a back seat to a broader set of goals. Lagarde also commented that changes in the geopolitical map and trade patterns could result in changes of some countries FX reserve mix by as much as 30%. This comes as further evidence of the global “de-dollarization” trend.

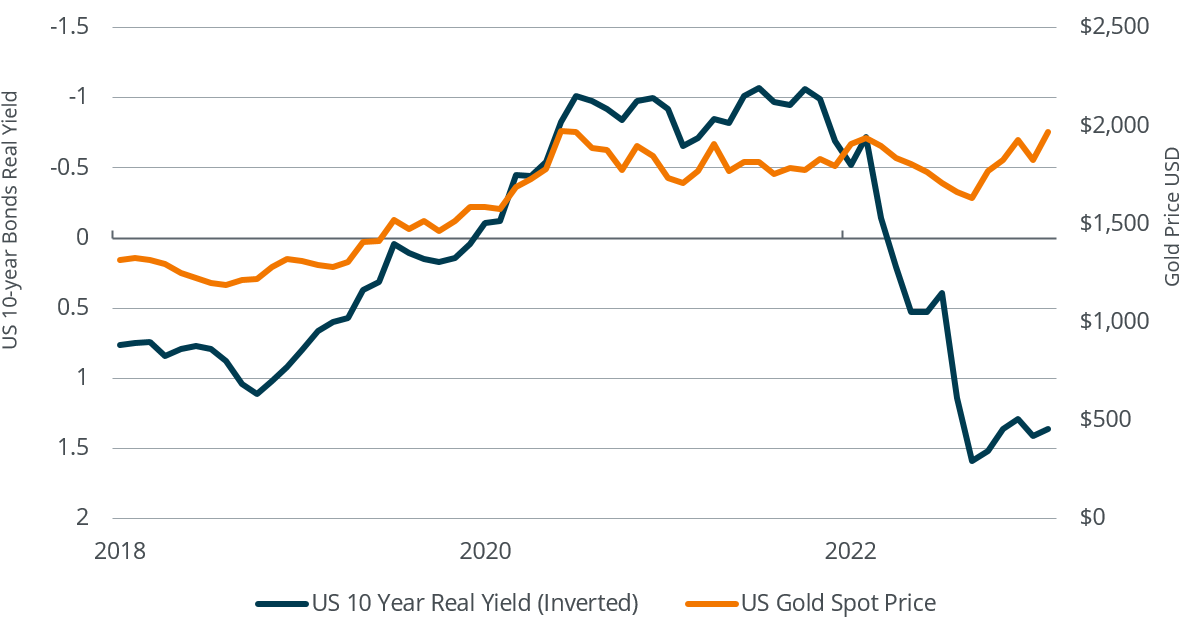

Important that we frame this in terms of investment opportunities/risks. We expect to see continued support for precious metals in the medium-term given the previously mentioned drivers. As highlighted in Figure 2, a disconnect between gold and real yields has recently emerged, likely driven by heightened geopolitical tensions and systemic risks stemming from the US regional banking crisis. While these systemic risks appear to be receding, it is our view that real yields are heading lower, US economic conditions are set to continue deteriorating, geopolitical tensions will remain elevated, and the US dollar is in structural decline, thus providing support for precious metals.

Relationship between gold and real yields inverted

Figure 2: Gold vs US 10-year Bonds Real Yield Inverted Source: Bloomberg, SG Hiscock & Company

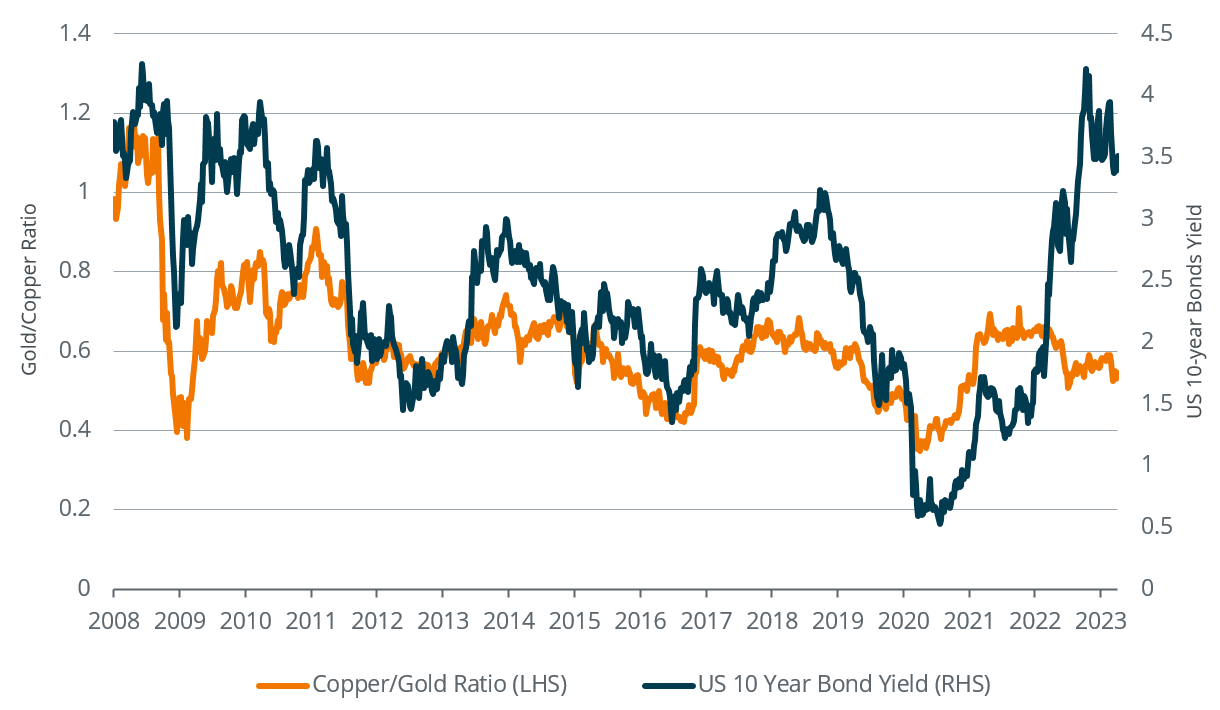

Following on with the theme of contrarian magazine covers – an ominous warning sign for the US economy which copper/gold (Figure 3) appears to corroborate

The copper/gold ratio appears to suggest another leg down in yields could precipitate – likely driven by deteriorating economic conditions, further disinflation and rate cuts running into 2024

Figure 3: Copper/Gold ratio vs US 10-year Bonds Yield Source: Bloomberg, Zillow, SG Hiscock & Company

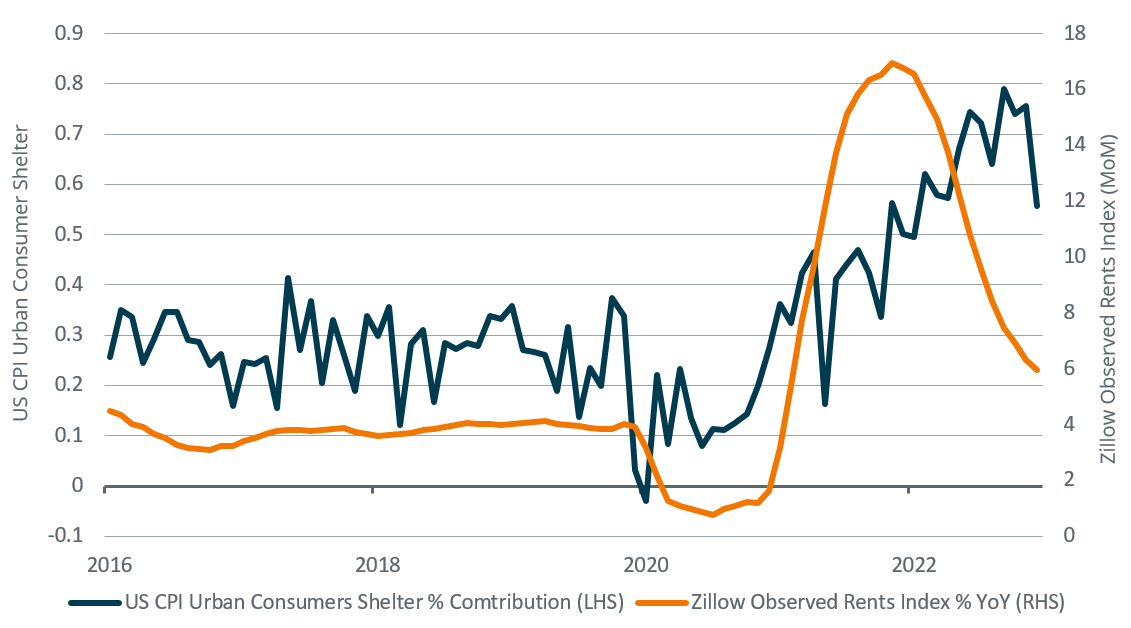

Finally, in the November edition of insights we noted that settlement prices (rents) were accounting for a substantial 40% of core CPI increases, with the data used being backward looking. Our observations of current rents at the time, using data such as the Zillow Observed Rents Index, suggested that this contribution to the core CPI bucket was set to decline substantially with a lagging effect. March’s CPI release has come as the first data point to show that these lower rents are starting to feed into inflation readings, with further downward pressure expected.

Zillow Observed Rents Index (YoY) overlaying US CPI Shelter Contribution (MoM) – Zillow Observed Rents Index indicates that shelter contribution to CPI is set to decline further putting downward pressure on aggregate CPI

Figure 4: US CPI Urban Consumer Shelter Contribution (MoM) vs Zillow Observed Rents Index (YoY) Source: Bloomberg, Zillow, SG Hiscock & Company

Disclaimer: SG Hiscock & Company has prepared this article for general information purposes only. It does not contain investment recommendations nor provide investment advice. Neither SG Hiscock & Company nor its related entities, directors or officers guarantees the performance of, or the repayment of capital or income invested in the Funds. Past performance is not necessarily indicative of future performance. Professional investment advice can help you determine your tolerance to risk as well as your need to attain a particular return on your investment. We strongly encourage you to obtain detailed professional advice and to read the relevant Product Disclosure Statement and Target Market Determination, if appropriate, in full before making an investment decision.

SG Hiscock & Company publishes information on this platform that to the best of its knowledge is current at the time and is not liable for any direct or indirect losses attributable to omissions for the website, information being out of date, inaccurate, incomplete or deficient in any other way. Investors and their advisers should make their own enquiries before making investment decisions.