Environmental, Social and Governance

SG Hiscock & Company has had a formal board-endorsed environmental, social and governance (ESG) policy since 2010. Our policy articulates our approach to integrating ESG considerations into our investment decisions, our business, culture and daily operations. SG Hiscock & Company is a responsible investor and we take an active approach to integrating ESG considerations into our investment decision-making process. We believe that the effective governance and management of business risks has a direct impact on a company’s intrinsic value over the long term and helps to reduce investment risk.

As an investment manager, SGH recognises the role we can play in supporting and influencing the impact of ESG issues, whether it be through our active engagement with companies or our investment decisions. We believe that over time, good ESG practices deliver both direct and indirect impacts on shareholder value and provide a broader public community benefit.

SGH is committed to embed ESG considerations into our investment decision practices where the timeframe incorporated in the investment philosophy of the relevant fund is consistent with the medium to longer term nature of ESG factors.

To read our full SGH Group Environmental, Social and Governance policy, click here.

To read our full SGH Group Stewardship policy, click here.

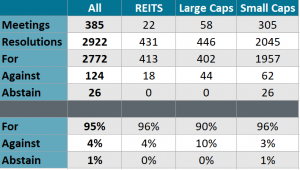

SGH Group Voting Summary 2022

To view SGH CY2022 Proxy Voting Report, click here.

SG Hiscock & Company is a signatory of the Principles for Responsible Investment and committed to incorporating environmental, social and corporate governance issues into our investment analysis and decision-making processes.

To find out more about the Principles for Responsible Investment click here.

Integrating ESG risks into our investment process

Stephen Hiscock, Executive Chair and Chief Investment Officer

“We’re focussed on continuous improvement, we’re actively seeking to have the best possible ESG practices implemented across our investment teams.”

Lucinda McGrath, ESG Manager

“Regardless of the method or the framework for reporting that information what’s important is that it’s meaningful to investors and the same can be said of fund managers. A priority for us for the next 12 months is to improve the way we disclose our own ESG activity.“

Stephen Hiscock, Executive Chair and Chief Investment Officer

“We’ve seen companies that display strong sustainable investing practices or sustainable practices, they tend to perform well over time. So there’s a shareholder benefit as well from this.”

“As professional investors, we have a social responsibility to all stakeholders of companies that we invest in.”

Hamish Tadgell, Portfolio Manager – SGH High Conviction Fund

“ESG is really about how companies are managing what I would say 21st century business risks.”

“There’s a lot of empirical evidence that shows that companies that manage ESG risks better over the long term create more value for shareholders.”

“As professional investors, we have a social responsibility to all stakeholders of companies that we invest in.”

Tim Gough, Senior Portfolio Manager – SGH Individual Portfolios

“Whilst we have policies and procedures in place to ensure we manage our clients’ assets appropriately, what’s more important is actually how we live ESG in our day to day environment.”

Stratton Bell, Portfolio Manager – SGH Individual Portfolios & SGH Enhanced Income Trust

“In our view it comes down to one simple question, “Is this company sustainable over the long term across social, environmental and governance?” If it’s not then it’s not worth investing in.”

Grant Berry, Director and Portfolio Manager – AREITs

“We believe that companies that adopt good ESG practices and procedures, and importantly embed it in their culture will drive superior outcomes.”

Callum Burns, Director and Portfolio Manager – SGH ICE

“We invest in companies that have a sustainable competitive advantage.”