GREITs are in a uniquely strong position for growth in the current market dynamic

Global real estate investment trusts (GREITs) have delivered competitive, income driven total returns over the long term and pricing today offers an attractive opportunity for investors to add property to their portfolios.

Strong operating income growth is expected to continue, with new economy sectors overwhelmingly having the best growth prospects, according to Matthew Sgrizzi, chief investment officer at LaSalle Investment Management and the lead portfolio manager for SGH LaSalle Global Concentrated Property Fund offered in Australia. “REITs are in a uniquely strong financial position, with the potential to enjoy a virtuous cycle of accretive growth in current market dynamic,” he said.

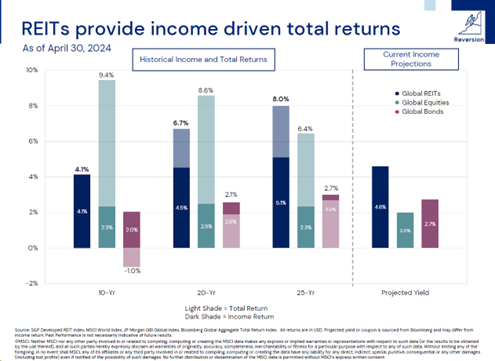

Real Estate Investment Trusts (REITs) have delivered a total gain of 8.0 per cent on average per annum over the 25 years to 30 April 2024, compared to 6.4 per cent for global equities and 2.7 per cent for global bonds, as the chart below shows, said Mr Sgrizzi.

“In addition, global REITs have delivered greater income returns to investors at just over 5 per cent per year over 25 years, well above the income return from both equities and bonds. We expect that to continue, with expected yields of over 4 per cent, greater than the 2 to 3 per cent expected yield from stocks and bonds. That clearly shows the power of income from global REITs,” said Mr Sgrizzi.

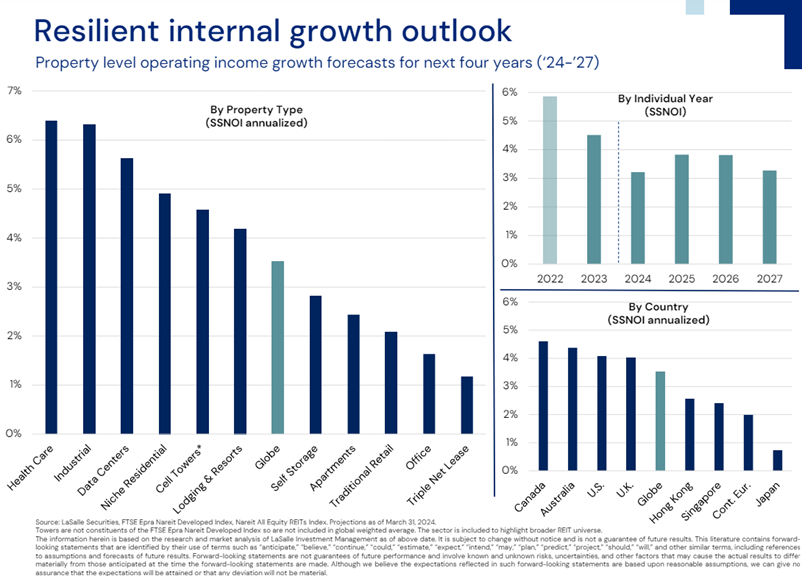

Looking ahead, global REITs are expected to produce operating income growth on a like-for-like basis of around 3.5 per cent per annum for the next four years. That compares well to historical growth of around 2 per cent, or around the level of long-term inflation.

“We are seeing strong earnings growth and much of this is being driven by new economy sectors such as data centres which are driving strong earnings, along with the healthcare, industrial and niche residential sectors,” Mr Sgrizzi said.

“Looking at data centres, the long-term operating outlook is favourable with demand underpinned by ongoing digital transformation and secular tailwinds including AI, cloud and mobile computing, data growth and bandwidth-intensive applications.

“More broadly, global REIT balance sheets are healthy. Leverage is just above 30 per cent and remains relatively low by historical standards. Global REITs also boast very high levels of fixed debt with average terms of six to seven years, so debt levels and costs are well contained.

“REITs can also borrow on an unsecured basis, which is much cheaper than secured or mortgage debt,” said Mr Sgrizzi.

The global REIT investable universe is massive, spanning 23 countries, over 450 listed real estate securities and 20-plus property types. The significant nature of the investment pool demands active asset selection, with active managers outperforming passive investment funds over time.

“REITs are a great sector to apply active management. The median REIT manager tends to outperform the REIT index by almost 100 basis points over time. Equity markets are dominated by non-specialist investors, who have more of a short-term focus and place less emphasis on total return or long-term opportunities, creating inefficiencies.

“In contrast, REITs are a small part of the equity market, but a large part of the institutional real estate universe, which creates informational differences. REIT managers can leverage their expertise to identify and seize mispricing between fair value and market price, which creates greater alpha opportunities and outperformance over time,” Mr Sgrizzi said.

LaSalle Investment Management Securities has US$3.1 billion in assets under management as of 1Q 2024. It partners with asset management firm, SG Hiscock & Company, which distributes the SGH LaSalle Concentrated Global Property Fund and SGH LaSalle Global Listed Property Securities Fund in Australia. Both funds have a ‘Recommended’ rating by Lonsec, and the SGH LaSalle Concentrated Global Property Fund also won the Global Real Estate Investment Trust category at the 2023 Zenith Fund Awards.

“Our concentrated approach gives investors access to the benefits of owning global real estate while only investing in the best opportunities we can find globally. We own great global assets and operating platforms that deliver strong income and capital returns to investors, often at a discount to what is offer in private markets.”

Past performance is not a reliable predictor of future performance.

The article contains general information only. Reference to either individual securities or other investments should not be considered as investment advice. We strongly encourage you to obtain professional advice before making an investment in securities that have been mentioned. Documents you should consider prior to making an investment could include the relevant Product Disclosure Statement and the accompanying Target Market Determination. If you would like further information on financial products that SG Hiscock & Company Ltd (AFSL 240679) is the investment manager for, contact the Client Services team on 1300 133 451, visit the website www.sghiscock.com.au or contact your financial adviser. Any investment is subject to risk, including possible loss of income or capital invested.