Morgan Stanley Engage Report: Proxy Voting

As long-term investors with an owner’s mindset, we value the role that proxy voting can play in enhancing long-term investment returns – and the increased attention paid to it by company boards and management. This means we do not outsource proxy voting decisions and never have.

Our voting seeks to be consistent with our assessment of the materiality of specific issues (ESG or other) to the sustainability of companies’ returns on capital, our monitoring of company progress, and our efforts to encourage companies towards better and/or more transparent practices.

Our portfolio managers seek to vote in a prudent and diligent manner and in the best interest of our clients, consistent with the objective of maximising long-term investment returns. Our proxy voting is predominantly related to governance issues such as management incentives and director appointments. As relevant, we consider how to vote on proposals related to social and environmental issues on a case-by-case basis by determining the relevance of the issues identified in the proposal and their materiality. We generally support proposals that, if implemented, would enhance useful disclosure or improve management practices on financially material ESG issues.

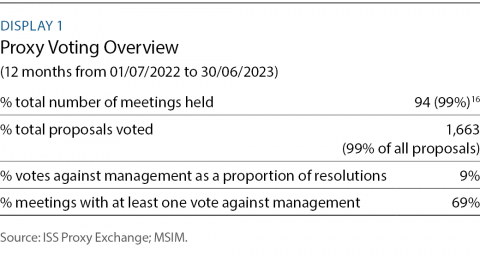

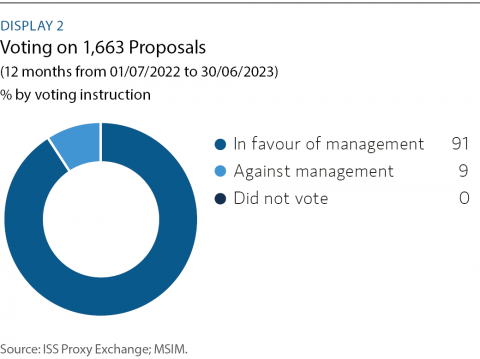

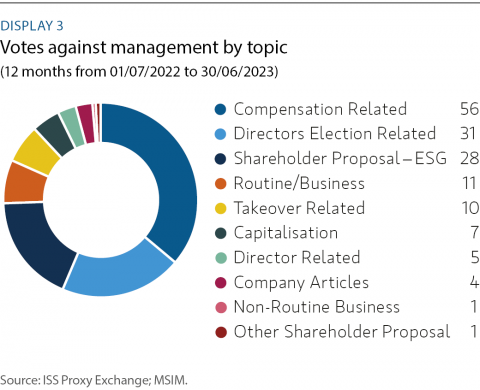

We are not afraid to disagree with management and third-party proxy advisers, such as ISS. In the 12 months to 30 June 2023, we voted at 94 meetings (100% of all meetings held by our companies) and on 1,663 proposals (100% of all proposals). Overall, we voted against management in 9% of cases, and 69% of meetings had at least one vote against management. Common reasons for voting against management were related to compensation, election of directors and shareholder ESG proposals.

Common reasons for voting against management were related to compensation, election of directors and shareholder ESG proposals.

|

|

|---|

Shareholder Resolutions

When we receive any environmental or social related shareholder proposals, we carefully consider how to vote on them by determining the relevance of the issues and the likely financial impact and its materiality. Overall, we supported 51% of shareholder ESG proposals across our strategies and voted against management in 45% of cases.

Say on Pay

Executive pay remained a key focus. We voted against 22% of management say on pay resolutions. Additionally, where we have had long-standing unresolved concerns over pay, we voted against members of remuneration committees to make our message heard. We also voted against nomination committee members if we have had concerns over diversity. In total we voted against the election of 27 (4%) directors in the last 12 months.

|

This article is part of the Morgan Stanley Engage February 2024 report.Download your copy of the report by clicking on the image on the right. |

|---|