Rob Hogg: Growth and earnings are resilient

Australian and global growth, and earnings remain surprisingly resilient as the outlook for the timing (and likelihood) of central bank policy cuts remains key.

Returns across global equity markets were solid in March, with many countries’ share market indices hitting record highs, including our own market.

After rising in February, most global bond yields slipped slightly over the month, generally led lower by shorter-dated market yields. The Australian dollar was again relatively little changed. Key market movements were as follows:

-

- S&P/ASX300 Accumulation Index (i.e., including dividends) rose 3.25%.

- S&P/ASX Small Ordinaries (Australian Small Companies) Accumulation Index rose 4.80%.

- US equity market (S&P500) rose 3.10%.

- Australian 10-year bond yield slipped from 4.14% to 3.965%.

- The US 10 bond yield also slipped, moving lower from 4.25% to 4.20%.

RBA Financial Stability Review and the banking sector

One of the features of the Australian share market in March was the solid performance of some of the banks, especially CBA and ANZ, although all of the four major banks have performed very solidly over the past three months.

For investors, fears of a potential negative impact on bank earnings from slowing economic growth and deteriorating lending conditions have so far proven overly pessimistic. The latest Financial Stability Review (FSR) published during March by the Reserve Bank of Australia (RBA) highlighted the continued generally robust financial environment for Australian banks as the RBA noted that:

“High inflation and interest rates have put pressure on household budgets over the past two years, but nearly all borrowers continue to service their debts on schedule… While housing and personal loan arrears have increased since late 2022, they remain below their pre-pandemic peak.”

The RBA noted that households’ ability to manage their finances during the recent period of rising interest rates and high inflation is due to several factors, including:

-

- The strong labour market, characterised by the low unemployment rate and the ability of workers to retain or find more work (including extra hours).

- Households adjusting their spending, particularly in discretionary areas such as retail and hospitality.

- Most households having entered this current period in a relatively strong financial position, with material spare cash flows and larger savings buffers than before the pandemic, so providing room for households to adjust to higher inflation and mortgage costs.

The RBA also noted that business sector conditions remain generally solid with most businesses’ operating profit margins (excluding interest expenses) remaining around pre-pandemic levels. However, some firms are experiencing more challenging conditions – generally those in discretionary spending sectors, as households have pulled back on consumption (as noted above).

Australian economic data

Underlining the local economy’s resiliency was the release of much stronger than expected jobs data during the month. While monthly numbers can contain “noise “, the reported fall in the seasonally adjusted unemployment rate to 3.7% in February (from 4.1% in January), and the 116,500 rise in the number of people employed, surprised investors.

However, it should be noted that the outsized increase in employment in February followed a weaker-than-usual outcome in December (-62,000), and a modest increase in January (15,000), leaving the February employment total (of 14,269,600) at a level consistent with its current trend rate of growth.

This solid employment report, along with the continued very slow pace of decline in inflationary pressures (“headline” rate unchanged at an annual rate of 3.4% for February but with “underlying” measures at 3.9%), point to the ongoing resiliency of domestic economic and financial conditions and suggest the risk remains that RBA rate cuts may be later than most commentators had hoped.

Offshore developments

Internationally, investor expectations about the future course of global central bank official interest rates again featured significantly in shaping market performances during the month.

While most global bond yields ended slightly lower at month’s end, this belies the intra-month volatility that saw global yields peak during the week of March 18-22, only retreating as several global central banks made “dovish” comment sat their key policy meetings during that week:

-

- The Bank of Japan noted that it “anticipates that accommodative financial conditions will be maintained for the time being.” Whereas investors had feared a potentials light tightening in overall policy settings may have occurred.

- The Bank of England said it “will keep under review for how long Bank rate [the official interest rate] should be maintained at its current level” noting that the “restrictive stance of monetary policy is weighing on activity in the real economy, is leading to a looser labour market and is bearing down on inflationary pressures.” Again, a more conciliatory statement than expected.

- The US Federal Reserve also provided a mild positive surprise for markets – simply by leaving unchanged both their key policy interest rate (at 5.25% – 5.50%), and their own expectation for three cuts in the policy rate later in 2024.

Investors had feared that the Fed may have revised their outlook to expect fewer rate cuts in 2024. The Fed continued to highlight the key importance of the path of inflation noting that “the [policy-making] Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

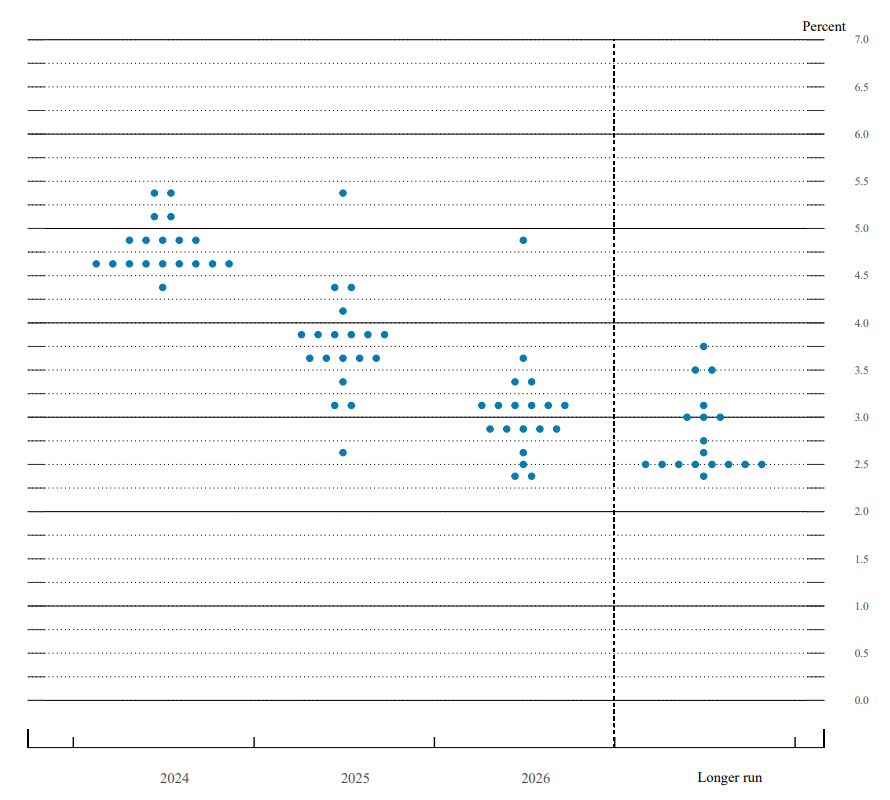

FOMC members’ forecasts of the future target level for the federal funds rate

The chart above shows the path of official US interest rates as forecast by members of the Fed’s own monetary policy committee – the Federal Open Market Committee (FOMC). These so-called “dot-plots” are examined by investors to understand not only the current “median” FOMC member’s expectation for the path of future policy rates (the Federal Funds Rate), but also whether the median has moved from meeting to meeting.

The positive surprise for markets during the month was that the median expectation for rate cuts – three in total for calendar 2024 – had not changed from the expectation at the time of the prior meeting in January. Investors had feared that the median expectation may have moved to expect only two rate cuts this calendar year.

For the US Federal Reserve to begin their rate cutting program, inflation will need to continue easing in both its month-to-month rate of change and in its breadth.

The key risk to this outlook still seems to be that, with the US economy remaining relatively resilient, inflation pressures will ease only very slowly, so restricting the ability of the Fed to cut rates any time soon.

With markets near unanimously expecting rate cuts before the end of the year, this remains the key risk to this market-supportive consensus outlook.

Disclaimer: SG Hiscock & Company has prepared this article for general information purposes only. It does not contain investment recommendations nor provide investment advice. Neither SG Hiscock & Company nor its related entities, directors or officers guarantees the performance of, or the repayment of capital or income invested in the Funds. Past performance is not necessarily indicative of future performance. Professional investment advice can help you determine your tolerance to risk as well as your need to attain a particular return on your investment. We strongly encourage you to obtain detailed professional advice and to read the relevant Product Disclosure Statement and Target Market Determination, if appropriate, in full before making an investment decision.

SG Hiscock & Company publishes information on this platform that to the best of its knowledge is current at the time and is not liable for any direct or indirect losses attributable to omissions for the website, information being out of date, inaccurate, incomplete or deficient in any other way. Investors and their advisers should make their own enquiries before making investment decisions.