Rob Hogg: Influenced by News

Influenced by news of slowing inflation and growth momentum in the US in particular, June was a positive month for most global equity and bond markets (with bond yields falling). French markets were an exception as political uncertainty rose with the calling of an early election.

In Australia, economic data is bifurcated – with employment and inflation data remaining resilient even as consumer and housing data softens, so making the policy task for the Reserve Bank increasingly difficult.

Key market movements over the month were as follows:

- S&P/ASX300 Accumulation Index (i.e. including dividends) rose 0.92%.

- S&P/ASX Small Ordinaries (Australian Small Companies) Accumulation Index fell 1.39%.

- US equity market (S&P500) rose 3.5%.

- Australian 10-year bond yields moved lower from 4.41% to 4.325%.

- The US 10 bond yield fell from 4.50% to 4.36%.

During June the interplay of economic reports and market dynamics followed the recent pattern with “bad (economic) news being good (market) news”. As usual, having most influence on global markets were the US Employment (Non-farm Payrolls) and Consumer Price Index (CPI) reports.

Official interest rate cuts were announced by the Bank of Canada (BoC) and the European Central Bank (ECB), but both actions were largely as expected.

The surprise French election announcement led to weakness in French bonds and equities, with a slight negative impact also apparent in other continental European markets.

In Australia, continued resiliency in employment and inflation kept the Reserve Bank of Australia (RBA) on alert with the RBA stating in their June 18 decision to leave rates unchanged “that the Board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that outcome.”

Toward the end of the month the May Australian CPI release shocked domestic markets on the upside such that a rate hike by the RBA is now a possibility.

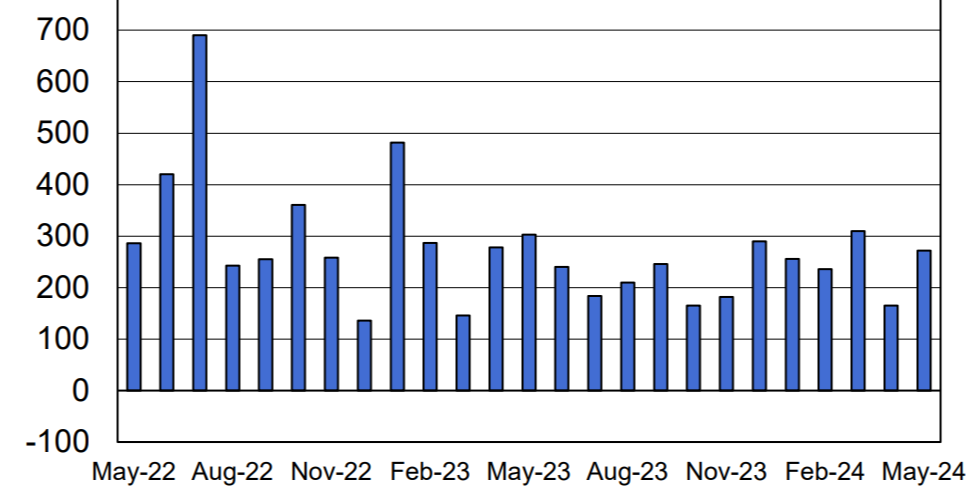

US May employment report provides an upside growth surprise

Announced on June 7, total US (non-farm) employment increased by a greater than expected 272,000 in May, and the unemployment rate remained little changed at 4.0%.

This upside growth surprise led to a sell-off in bonds (with yields rising) and weaker equity markets on the day.

Monthly change in US nonfarm payroll employment (May 2022 – May 2024)

Source: US Bureau of Labor Statistics, The Employment Situation, News Release 7 June 2024, link

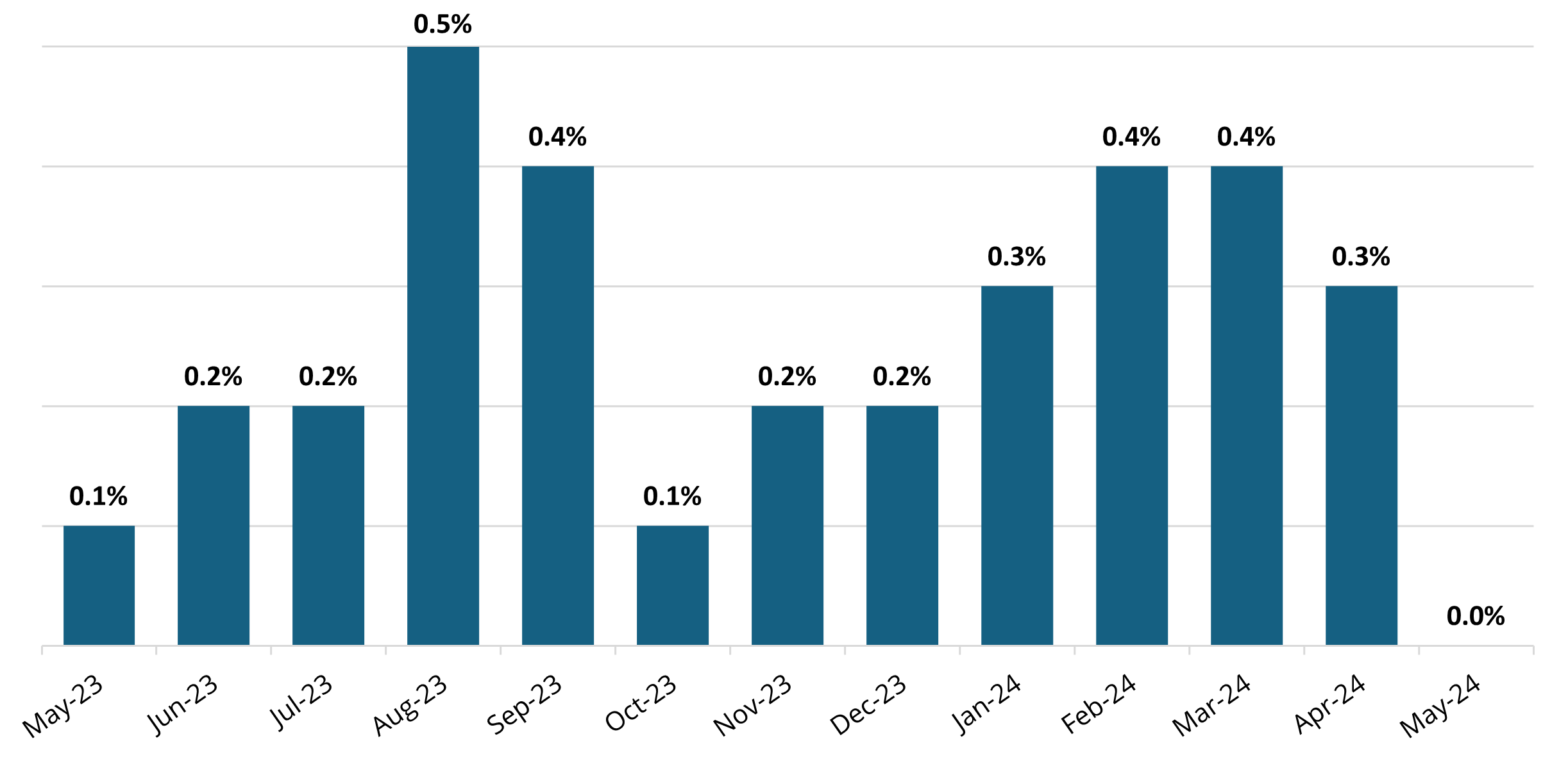

US May CPI

Mid-month downside surprise in the May US CPI swamps the impact of the US Fed’s latest “rates on hold” announcement on the same day.

On June 12 a significant downside surprise in the US May Consumer Price Index (CPI) drove equity and bond prices higher, although some of the market enthusiasm early in the trading day following the report’s release was doused by the US central bank’s Federal Open Market Committee (FOMC) decision that was announced later that same day.

Overall, the CPI release had more impact on markets on the day with both the headline and core CPI measures reported at a less than expected 0.0% and 0.2% respectively.

Monthly change in US CPI (May 2023 – May 2024)

Source: US Bureau of Labor Statistics, Consumer Price Index, 12 June 2024, link

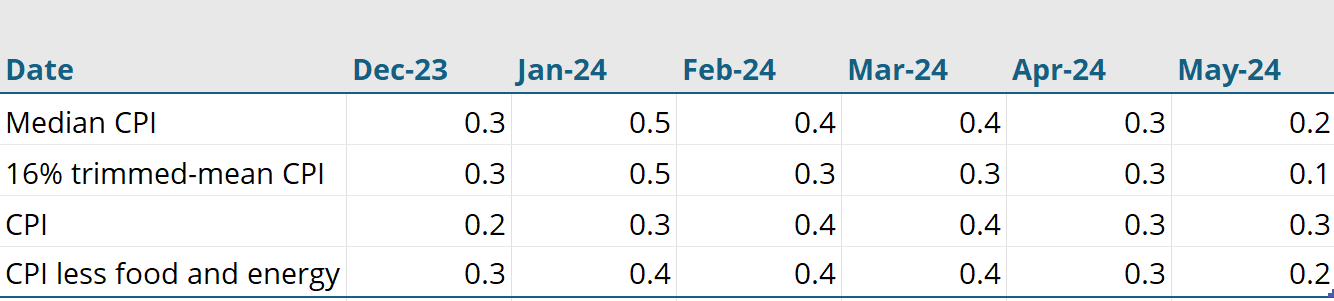

Of most importance in the CPI report was the improvement in underlying measures of inflation, such as those produced by the Federal Reserve Bank of Cleveland that measure “median” and “trimmed mean” inflation.

These are measures that give a read on the breadth of inflation, and both suggested an easing in broader inflation pressures in the US economy as exhibited by slowing rates of monthly growth.

Cleaveland Federal Reserve’s median trimmed mean measures (monthly % change)

Source: Federal Reserve Bank of Cleaveland, Median Consumer Price Index, Update 12 June 2024, link

From a monetary policy standpoint, the easing of underlying inflation pressures is extremely positive as it is an easing in inflation momentum (if it continues) that will enable the US Fed to cut rates if economic growth continues to soften.

But these broadening signs of slowing in US growth (which the CPI results are likely reflecting), suggest that investors will need to be on the alert for signs of downside earnings risks which are likely to accompany these moderating growth and inflation trends.

Directly following the release of the CPI early in the US trading day, market pricing moved to reflect two expected cuts to the benchmark Federal Funds Rate (FFR) by end year. But this expectation retreated to around 1 ½ cuts following the US central bank’s FOMC announcement later in the trading day. The FOMC announcement was regarded as mildly bearish as the committee revised down its expected number of rate cuts by end year from three to one (the so-called “dot-plots”), while the FOMC upwardly revised its inflation and long-term interest rate expectations over the next few years.

The key wording change in the FOMC Statement was to acknowledge “modest further progress” toward the 2% inflation objective (instead of noting “a lack of progress”).

Rate cuts by the Bank of Canada and the European Central Bank

Rate cut announcements by both the Bank of Canada (BoC) and European Central Bank (ECB) during the month were as expected and didn’t have significant market impact.

On June 5 the BoC reduced its target for the official overnight rate by 0.25% from 5.0% to 4.75% saying CPI inflation eased further in April, to 2.7% and that

“the Bank’s preferred measures of core inflation also slowed and three-month measures suggest continued downward momentum.”

On the following day (June 6) the ECB also announced a 0.25% reduction in its key official interest rate targets saying that “underlying inflation has … eased, reinforcing the signs that price pressures have weakened, and inflation expectations have declined…”.

Interestingly, the ECB went on to note that,

“despite the progress over recent quarters, domestic price pressures remain strong as wage growth is elevated, and inflation is likely to stay above target well into next year”

and that the latest

“projections for both headline and core inflation have been revised up”.

By emphasising that inflation pressures remain strong, the ECB seems to be suggesting that their next rate cut may be some time away.

Surprise French election announcement creates market uncertainty

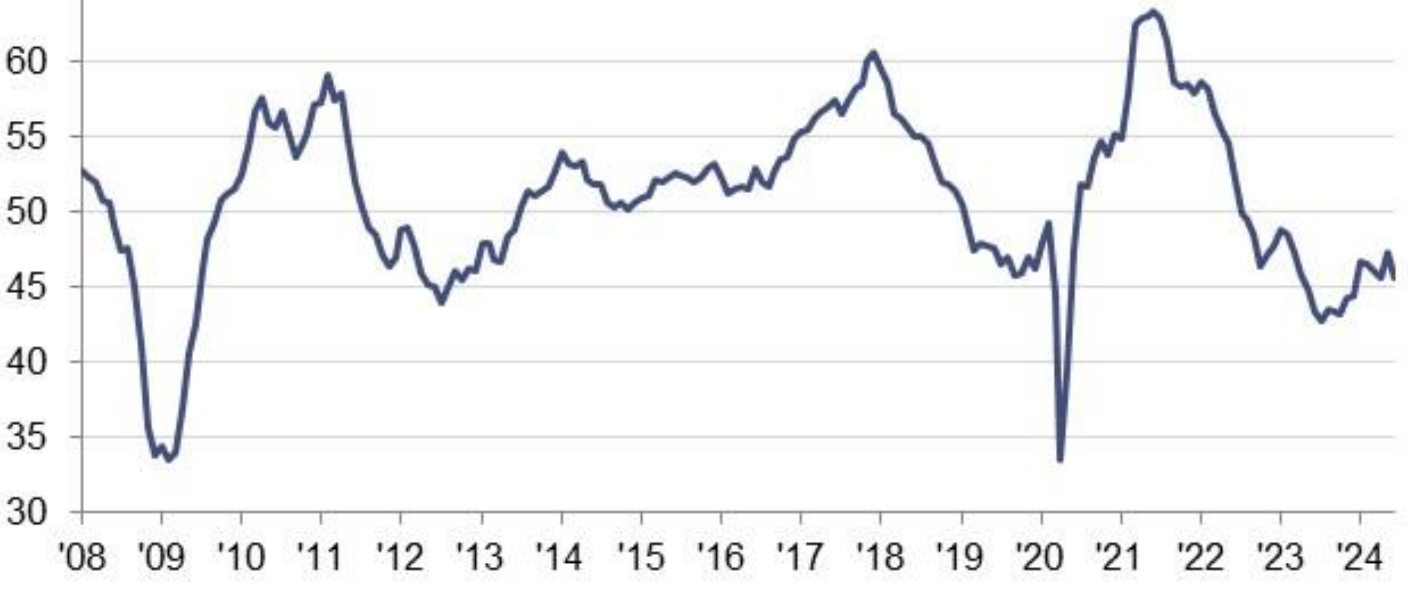

Two key data reports released in Europe during the month point to slowing in the Eurozone economy.

One of these reports – the S&P PMI sentiment survey – showed that the composite index (measuring the manufacturing and services sectors) dropped to 50.8 in June from 52.2 in May.

According to the survey, growth in the Eurozone was again limited to the service sector with manufacturing contracting. Key to the weakness in the index was a renewed fall in new orders, their first decline in four months. The German economy seems to be losing momentum while, in France,

“the worsening situation… might be tied to the results of the recent European Parliament election and President Macron’s announcement of snap elections on June 30 [which] has likely stirred up a lot of uncertainty about future economic policies…”

French Manufacturing Purchasing Managers’ Index (PMI)

Source: S&P Global, Release Date 21 June 2024, link

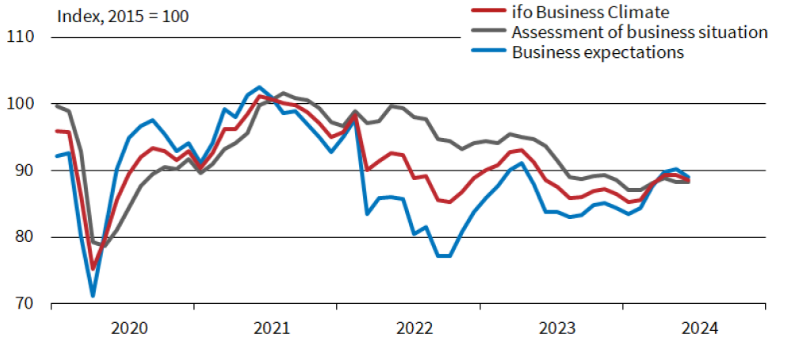

As noted above, weakening trends are not only observable in France, but the German economy has also been softening, as illustrated by the latest Ifo survey of industry sentiment across the manufacturing, retail, and construction sectors. The services sector is performing relatively better but is being overwhelmed by softness elsewhere in the economy.

Ifo German Business Climate Survey

Source: ifo Insitute, ifo Business Climate Index, Release Date 24 June 2024, link.

Australian employment data surprise on the upside again

Employment and inflation data remain resilient, discretionary retail spending weak.

In yet another employment-related upside surprise , the number of people employed increased by almost 40,000 in May which contributed, along with a fall in the number of people unemployed, to a fall in the unemployment rate to 4.0% from 4.1%.

Measured on a trend-basis, employment is still increasing by 38,700 per month with the number of people employed up by 2.7% since May 2023.

Australian employment (May 2023-May 2024)

Source: Australian Bureau of Statistics, Labour Force, Release 13 June 2024, link.

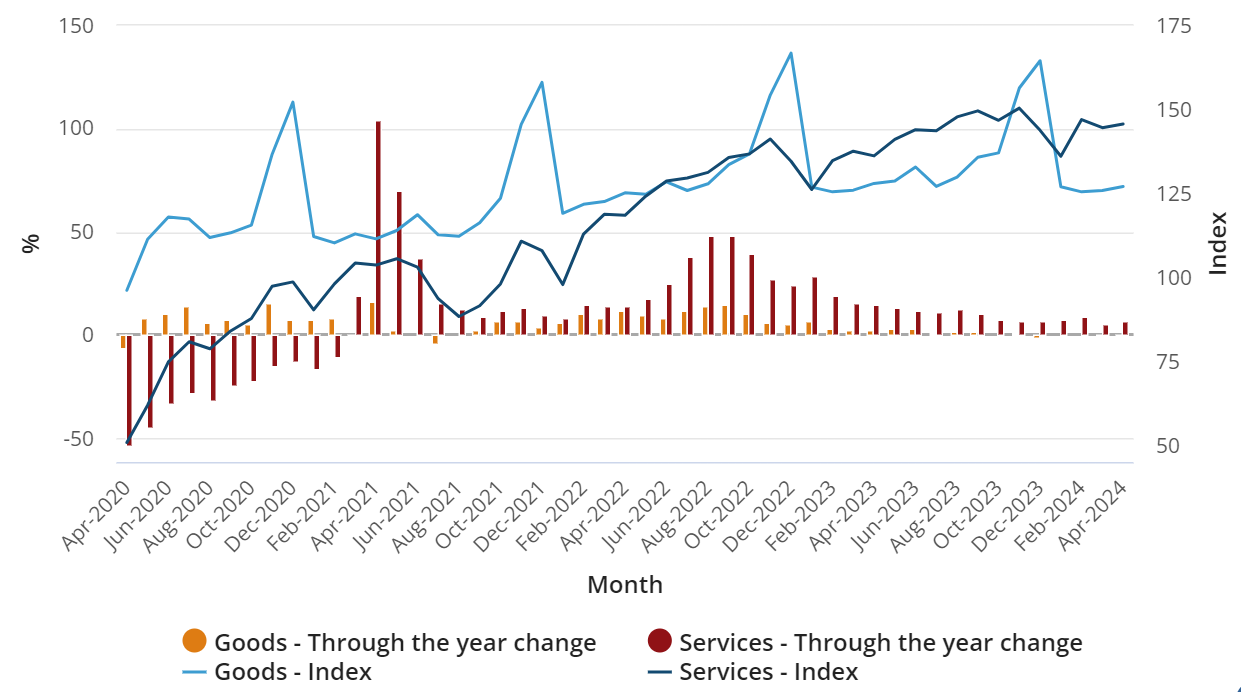

Australian household spending

Australian household spending increasingly skewed toward non-discretionary items, discretionary spending being “crowded-out”.

The ABS reported in their latest Monthly Household Spending Indicator (an experimental indicator of household spending using bank transactions data) that household spending in April continued to be biased significantly toward non-discretionary spending. Over the year to April:

- non-discretionary spending rose 5.8%, driven by increased spending on health and on the purchase and operation of vehicles.

- discretionary spending rose just 0.6%, driven by slightly increased spending on furniture and household equipment.

This dispersion in spending patterns is similar to the pattern exhibited by the ABS’s retail sales release and in the National Accounts whereby the rising cost of non-discretionary goods and services is diminishing the ability for consumers to spend on discretionary goods and services such as alcohol and tobacco; clothing and footwear; furniture, floorcoverings and household goods; household appliances and tools; goods for recreation and culture; and accommodation services.

Non-discretionary and discretionary household spending (April 2020 – April 2024)

Source: Monthly Household Spending Indicator, April 2024 | Australian Bureau of Statistics (abs.gov.au)

Australian CPI

Australian Consumer Price Index (CPI) surprises on the upside again, making the path for the RBA extremely difficult.

The monthly CPI indicator rose 4.0% over the year to May 2024, accelerating from 3.6% over the year to April. Measured on an underlying basis (which excludes automotive fuel, fruit and vegetables, and holiday travel). the annual rate of change slowed slightly from 4.1% in April but, at 4.0% in May, remains too high for the RBA to be considering cutting official interest rates any time soon.

In fact, other underlying measures (such as the “trimmed mean”) accelerated in annual terms in May – rising 4.4% in May, up from 4.1% in April.

Key upward influences on the CPI’s annual increase were housing (+5.2%), rents (+ 7.4%), new dwellings (+4.9%) and electricity (+6.5%). The increase in the trimmed mean considerably raises the risk that the RBA might have to raise rates again.

Monthly Australian CPI Indicator

Source: Monthly Consumer Price Index Indicator, May 2024 | Australian Bureau of Statistics (abs.gov.au)

Australian Companies warning of slowing economic conditions

During the month a number of companies provided commentary highlighting soft(ening) consumer demand:

- Metcash (ASX: MTS) (food, liquor, hardware) reported that“in supermarkets, the business continued to perform well in an environment of increased value-conscious shopping…items per basket declined reflecting cost of living pressures on household grocery budgets. Sales of private label products increased 15.5%, and sales of items on promotion grew faster than those not on promotion”

- Collins Foods (ASX: CKF) (fast food) reported that“while the Quick Service Restaurant (QSR) sector is one of the most resilient, it is not immune to the ongoing cost-of-living pressures facing consumers. As expected, trading conditions were softer in the second half given the dual impacts of inflation across all input lines and weaker consumer sentiment”.

- Star Entertainment (ASX: SGR) (casinos) reported that”current trading conditions reflect the challenging economic environment and cost of living pressures. Group revenue… is expected to be 4.3% below the previous quarter…and 3.3% below the prior corresponding period (pcp).”

- Cettire (ASX: CTT) (luxury goods) reported that“since our market update in mid-April, (…) we have observed more challenging market conditions. A softening demand environment and an increase in promotional activity has been visible across our footprint, particularly in the last several weeks as the market has entered the Spring Summer 24 sale period. Additionally, we believe the market is currently being impacted by clearance activity as certain players exit parts of the market”.

Evolving expectations about monetary policy will continue to drive markets

As we have noted previously, evolving investor expectations about future central bank policy actions will likely continue to be the most important driver of market performances.

Market sentiment has shifted dramatically since the start of the year from a benign outlook (slowing inflation and growth, allowing central banks to cut interest rates so cementing a “soft-landing”) to a less market supportive forecast environment of higher-for-longer interest rates as central banks attempt to squeeze inflationary pressures out of the system.

Along these lines, it was interesting that even as the ECB cut rates during June (as discussed above), their upwardly revised forecast for expected inflation suggests that even some rate-cutting central banks feel a higher rates-for longer scenario is still likely. In Australia the RBA seems now to be facing a policy dilemma of softening macroconditions coexisting with extremely sticky inflation outcomes.

More extreme scenarios, such as stagflation – anaemic growth and ongoing inflation – are at risk of becoming a higher probability if inflation remains resilient and growth slows, with central banks limited in their ability to react in such an environment. The latest news in Australia of ever weakening retail sales in the midst of resilient inflation is not a great combination.

Read Rob’s previous macro updates | Watch his March quarter video

Disclaimer: SG Hiscock & Company has prepared this article for general information purposes only. It does not contain investment recommendations nor provide investment advice. Neither SG Hiscock & Company nor its related entities, directors or officers guarantees the performance of, or the repayment of capital or income invested in the Funds. Past performance is not necessarily indicative of future performance. Professional investment advice can help you determine your tolerance to risk as well as your need to attain a particular return on your investment. We strongly encourage you to obtain detailed professional advice and to read the relevant Product Disclosure Statement and Target Market Determination, if appropriate, in full before making an investment decision.

SG Hiscock & Company publishes information on this platform that to the best of its knowledge is current at the time and is not liable for any direct or indirect losses attributable to omissions for the website, information being out of date, inaccurate, incomplete or deficient in any other way. Investors and their advisers should make their own enquiries before making investment decisions.