Rob Hogg: A month of two halves

Another month buffeted by oscillating news about the growth and inflation outlook.

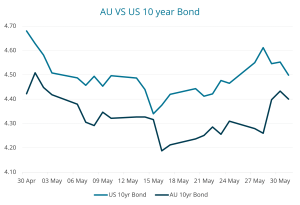

May was a month of two halves for equity and bond markets. In the first half of the month equity and bond prices rose (bond yields fell), but the second half of the month witnessed a turnaround taking many equity markets lower from record intra-month highs.

Similarly, after bond yields initially fell (bond prices initially rose), yields ended the month flat to slightly lower, with yields drifting higher from mid-month lows.

In the midst of these moves in equity and bond markets, the Australian dollar rose from around USD 0.6470 to USD 0.6650. Key market movements over the month were as follows:

- S&P/ASX300 Accumulation Index (i.e., including dividends) rose 0.85%.

- S&P/ASX Small Ordinaries (Australian Small Companies) Accumulation Index fell 0.05%.

- US equity market (S&P500) rose 4.8%.

- Australian 10-year bond yield slipped very slightly from 4.425% to 4.411%.

- The US 10 bond yield fell from 4.68% to 4.499%.

Daily observations through May of S&P 500 vs ASX 200 and US vs AU Bond Yields

Source: SGH, Iress

Oscillating sentiment regarding the outlook for potential central bank rate cuts (or increases) continued to cause gyrations in markets.

As has been the case all year, it was key economic data reports that most impacted overall market direction through the month with a number of reports in the first half of the month suggesting that inflation and growth might be easing enough for central banks to cut rates – if not soon, likely before the end of the year.

But the second half of the month witnessed reports suggesting that inflation and growth momentum was probably too rapid to allow any near-term rate cuts, and perhaps not even until 2025. This caused investors’ expectations to change through the course of the month. By the end of the month US markets were pricing between one and two rate cuts by the end of 2024 while in Australia markets are not pricing a cut ahead of year end.

As is almost always the case, it was US data and US markets that provided the lead in May. In the first half of the month economic reports in the US, while still pointing to ongoing resilience, were broadly in-line with expectations, or slightly weaker than expected.

These in-line or softer than expected releases drove market interest rates lower and contributed to are bound in equity markets.

For markets, bad news is good news

Sometimes described as ”bad news is good news”, gently softening data – slowing inflation and easing growth momentum – is regarded as raising the likelihood of official interest rate cuts which are seen as supportive for equity market earnings, and therefore supportive for equity markets. Conversely, stronger than expected inflation and growth data is regarded as likely either to postpone the timing of rate cuts or to raise the possibility of further rate hikes. The first half of May saw investors adjust their expectations in the direction of expecting a higher likelihood of rate cuts as reports came in-line or softer than expected.

Published in the first half of the month are the two key reports on which the US central bank (the Federal Reserve) is most focussed, and they relate to the state of the labour market, and evolving inflation dynamics. While continuing to point to ongoing momentum in the economy, both reports suggested that the pace of growth in employment and prices was slowing:

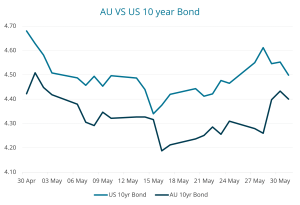

- The number of new jobs (as measured by non-farm payrolls) totalled a lower-than-expected 175,000 in April, and the unemployment rate was changed little at 3.9%. The unemployment rate has remained in a narrow range of 3.7% to 3.9% since August 2023.

Monthly change in the number of US non-farm payroll employment April 2022 – April 2024

Source: US Bureau of Labor Statistics, The Employment Situation, News Release 3 May 2024, link

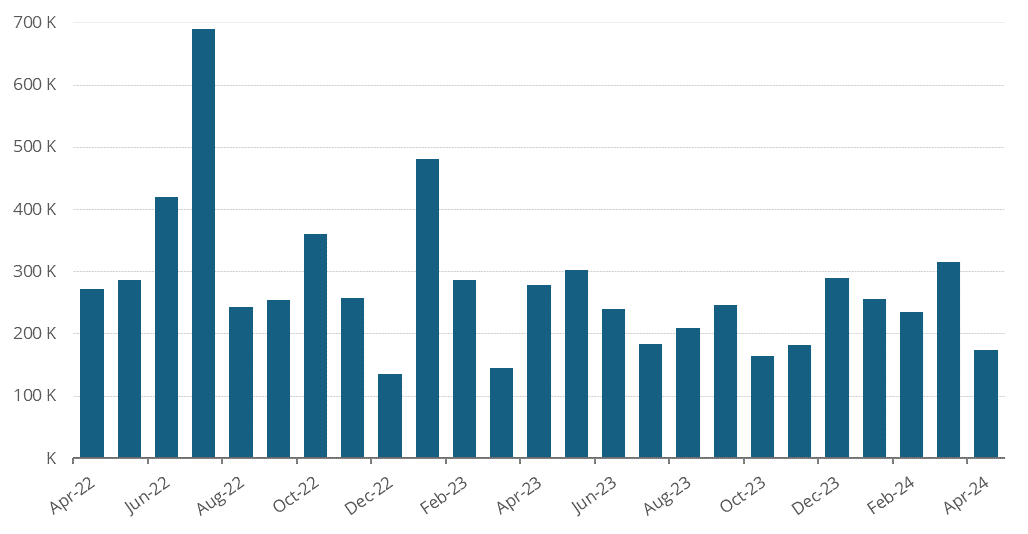

- The monthly rate of inflation was reported in line with expectations (and lower than feared) for April, increasing 0.3% after rising 0.4% in March. Importantly, “core” inflation (excluding food and energy costs) rose 0.3%, after rising 0.4% in each of the three preceding months.These monthly changes have caused the headline rate of inflation to ease slightly when measured compared with the same month a year ago (to 3.4% from 3.5%) and caused the annual growth in the core inflation index to move to 3.6% from 3.8%.

Monthly percentage change in the US Consumer Price Index: April 2023 – April 2024

Investor sentiment changed in the second half of the month

As the second half of the month unfolded US economic reports veered toward suggesting slightly more resiliency in growth and inflation, and this heavily influenced the change in market direction, as did a series of poorly received US Treasury bond auctions:

- US consumer confidence rose in May for the third consecutive month as “the strong labor market continued to bolster consumers’ overall assessment of the present situation” while expectations were bolstered by the fact that “fewer consumers expected deterioration in future business conditions, job availability, and income.”

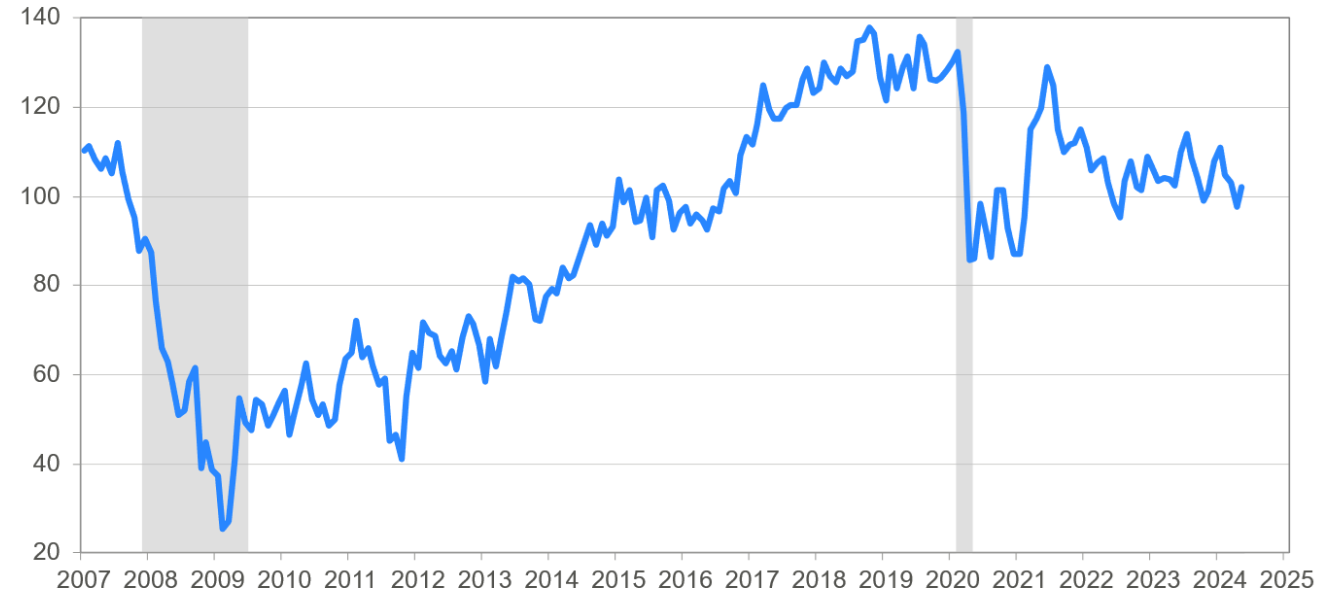

US Consumer Confidence Index

Index. 1985 =100

* Shaded area represent periods of recession, Sourses The Conference Board, NBER

Press Release: US Consumer Confidence rose in May, 28 May 2024, link

- The final week of May included three Treasury auctions for USD 69 billion of two-year Treasuries, USD 70 billion of five-year Treasuries and USD 44 billion of seven-year Treasuries. Demand by buyers at these auctions was generally weaker than had been recorded at prior auctions and this exacerbated the souring sentiment toward bonds later in the month.

Inflation reports in the UK and Germany also impacted market sentiment

But also important in driving bond yields higher (and equity prices lower) later in the month were upside surprises in UK and German consumer prices:

- UK April consumer prices rose by 0.3% (+0.1% had been expected) after rising 0.6% in both of the previous two months.

- German May consumer prices surprised on the upside with the annual change in the (“Harmonised”) CPI rising to 2.8% (2.7% was expected), an acceleration from 2.4% over the year to April and 2.3% in March.

Last Day Surprise from the US

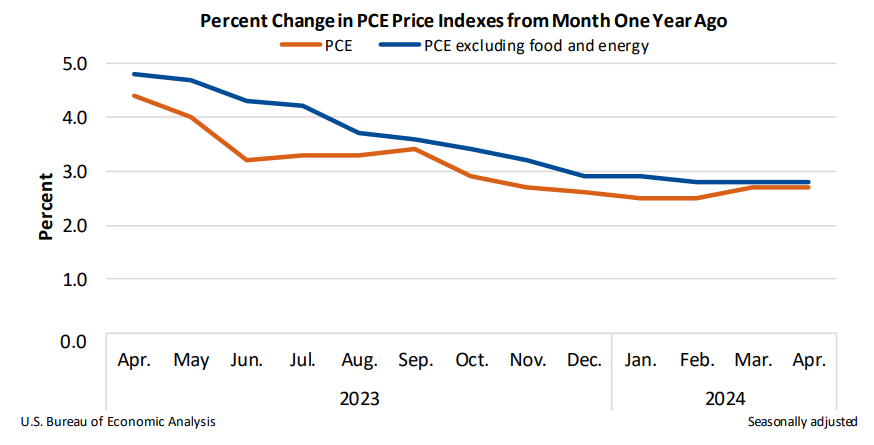

Fittingly for a month with changes in sentiment, the last day of May witnessed the release of another key inflation indicator for the US Central Bank – this indicator measures prices for goods and services purchased by US consumers, with an underlying measure (the “Core” Personal Consumption Expenditure Deflator) getting most market focus.

This measure of consumer prices rose by a lower than feared 0.2% in April so leaving the annual rate of change in this measure of inflation at 2.8%. This release caused equity and bond prices to rally on the final day of the month.

Personal Consumption Expenditures Index

Source: US Bureau of Economic Analysis, PCE Index, Release date 31 May 2024, link

US monetary policy expectations gyrated

Reflecting the gyration in investor sentiment over the month, the implied yield on the December Fed Funds futures contract (which prices investor’s expectations for the official fed funds rate) moved from around 5.10% at the end of April to 4.92% in mid-May before moving to 5.055% as at the end of May so implying little more than one rate cut before year’s end relative to the current Fed Funds rate at 5.375% (the mid-point of the Fed’s targeted range of 5.25% – 5.50%).

Australian retail sales soft while employment and inflation remain resilient

Australian share and bond markets followed the pattern in the US with Australian equity and bond prices rising (bond yields falling) in the first half of the month before weakening in the second half (bond yields rising). Three key reports stand out in Australia over the month – retail sales, consumer prices and employment:

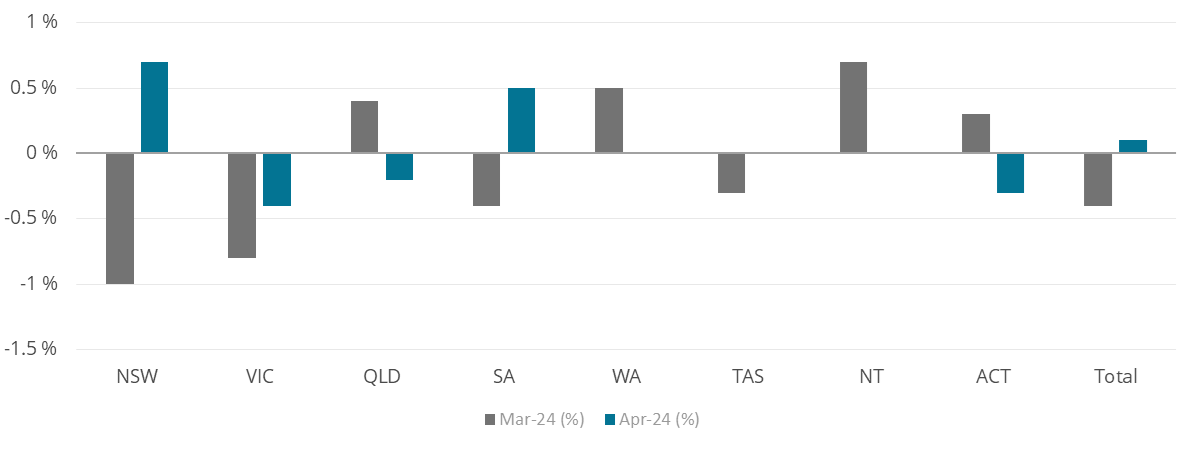

- Australian retail turnover rose just 0.1% in April 2024 following a 0.4% fall in March and a 0.2% rise in February 2024. Retail sales in Victoria have been especially weak in the past two months, falling in both months. The Australian Bureau of Statistics (ABS) noted that

“underlying retail spending continues to be weak with a small rise in turnover in April not enough to make up for a fall in March… Looking across the past two months, we see weak underlying spending in most parts of the retail industry.”

Australian monthly retail sales by state – March and April

Source: Australian Bureau of Statistics, Retail Turnover, Release date 28 May 2024, link

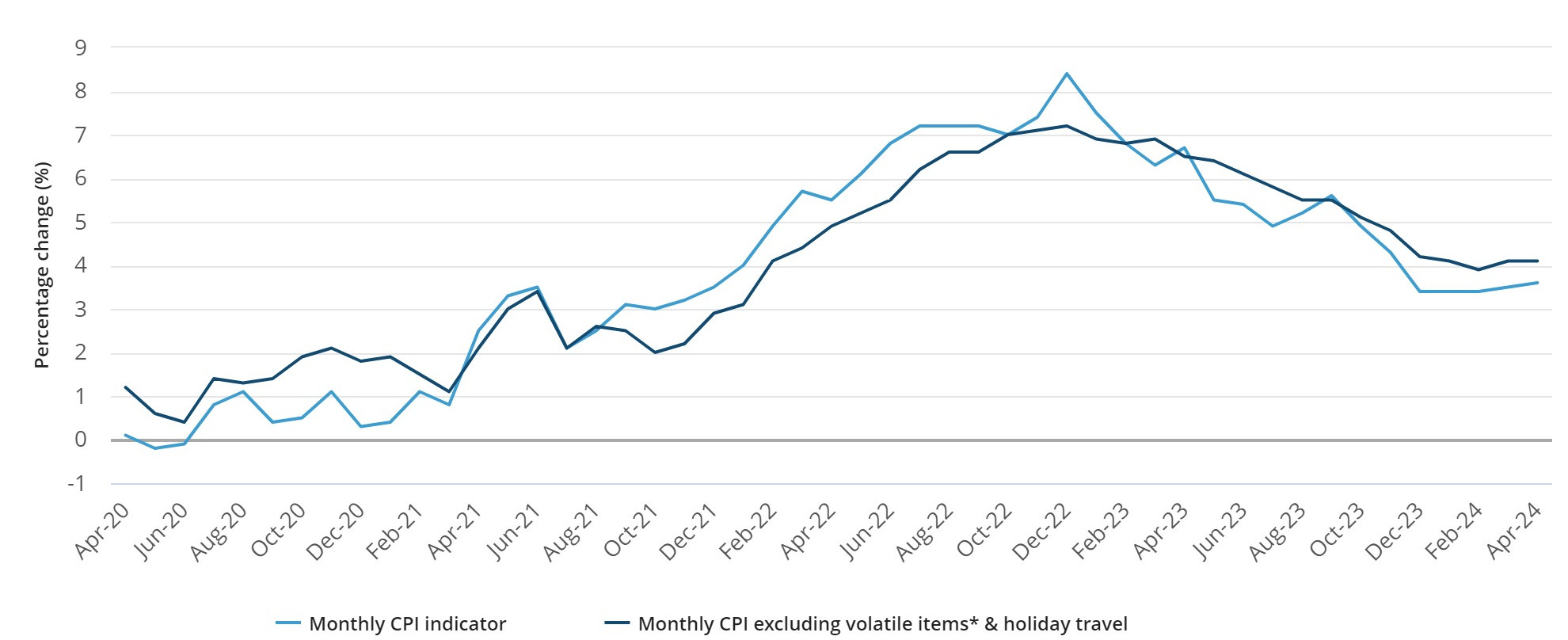

- The monthly Consumer Price Index (CPI) indicator surprised on the upside, rising 3.6% over the year to April, up from 3.5% in March. Although the monthly indicator has been relatively stable over the past five months, April was the second month in a row where annual inflation had a small increase. The annual growth of “underlying” inflation was steady at a still-too-high 4.1%.

Annual Change in the Australian CPI Indicator

*Volatile items are Fruit and vegetables and Automotive fuel

Source: Australian Bureau of Statistics, Retail Turnover, Release date 28 May 2024, link

- The April employment report revealed that the labour market remained relatively tight even as the unemployment rate rose very slightly to 4.1% and employment rose by 38,500. Resiliency in the data is best exhibited by the fact that the unemployment rate has barely risen from its low of 3.5% reached in 2022 but also that “trend” monthly employment growth remains at around 30,900.

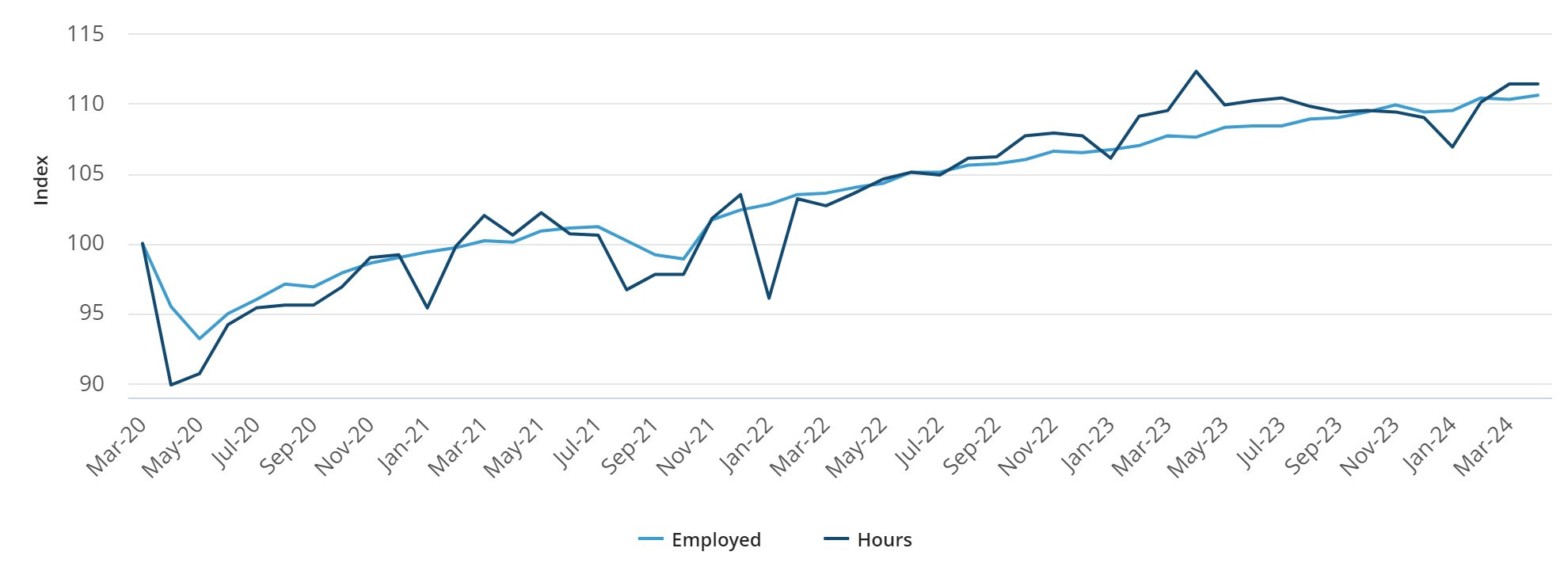

Australian Employment and Hours Worked

Source: Australian Bureau of Statistics, Labour Force, Release date 16 May 2024, link

Other themes and developments during the month included:

- The Japanese Yen (JPY) remained soft over the month but enjoyed some respite from the 30-year lows reached in April following a speech by Bank of Japan (BoJ) Deputy Governor Uchida Shinichi who noted that:

“while we still have a big challenge to anchor the inflation expectations to 2%, the end of our battle is in sight,”

implying that the BoJ may take further moves to further tighten monetary policy in coming months.

- BHP announced on May 29 that it had decided not to make a firm offer for Anglo American saying that “we were unable to reach agreement with Anglo American on our specific views in respect to South Africa regulatory risk and cost.” This followed BHP making an increased and final offer to the Anglo board on May 20.

It’s likely that evolving expectations about monetary policy will continue to drive markets

Looking ahead, it is still likely that evolving investor expectations about future central bank policy actions will be the most important driver of market performances. Market sentiment has shifted dramatically since the start of the year from a benign outlook (slowing inflation and growth, allowing central banks to cut interest rates so cementing a “soft-landing”) to a less market supportive expected environment of higher-for-longer interest rates as central banks attempt to squeeze inflationary pressures out of the system.

More extreme scenarios, such as stagflation – anaemic growth and ongoing inflation – are at risk of becoming a higher probability if inflation remains resilient and growth slows, with central banks limited in their ability to react in such an environment. The latest news in Australia of ever weakening retail sales in the midst of resilient inflation is not a great combination.

Read Rob’s May update | Watch his March quarter video

Disclaimer: SG Hiscock & Company has prepared this article for general information purposes only. It does not contain investment recommendations nor provide investment advice. Neither SG Hiscock & Company nor its related entities, directors or officers guarantees the performance of, or the repayment of capital or income invested in the Funds. Past performance is not necessarily indicative of future performance. Professional investment advice can help you determine your tolerance to risk as well as your need to attain a particular return on your investment. We strongly encourage you to obtain detailed professional advice and to read the relevant Product Disclosure Statement and Target Market Determination, if appropriate, in full before making an investment decision.

SG Hiscock & Company publishes information on this platform that to the best of its knowledge is current at the time and is not liable for any direct or indirect losses attributable to omissions for the website, information being out of date, inaccurate, incomplete or deficient in any other way. Investors and their advisers should make their own enquiries before making investment decisions.