SGH Insights: US regional banking crisis and what it means for investment opportunities

By Rory Hunter, 30 March 2023

As my colleague, Hamish Tadgell, recently noted in his piece “Crisis of Confidence”, in many respects, we are not surprised we are starting to see some things break given the aggressive and coordinated nature of central bank rate moves.

Of growing concern to policymakers, economists and market participants is what the turmoil in the banking sector means for the medium-term availability of credit growth. In the US, the regional and community banks have been an important driver of loan growth for decades. Banks with less than $250bn in assets account for the following proportion of lending in the US economy:

- 50% of commercial and industrial lending

- 60% of residential and real estate lending

- 80% of commercial real estate lending

- 45% of consumer lending.

We are looking to frame this in terms of implications for the boarder equity market and specific sectors. Over the past 12 months, the market mantra has been that good news on growth has been bad news for stocks because of the impacts on inflation data and how such data feeds into policy decisions (interest rate hikes). So, if this mantra holds, could the bad news about the banking system and the resulting implications for credit growth be good news for stocks?

Given the above impacts on credit growth, economists estimate that the ensuing regional banking crisis in the US is equivalent to a Federal Reserve rate hike of a quantum of anywhere between 25bps and 150bps.

This is important for a number of reasons but most importantly where we reside in the US and global rate hike cycle. It is our view that we have reached a peak in the Fed funds rate, with potentially one 25bps hike left in May. What is of more importance is when we might start to see rate cuts, as this is an environment in which historically emerging companies have significantly outperformed their larger counterparts. It is our view that we will start to see rate cuts before year end, driven by the below data.

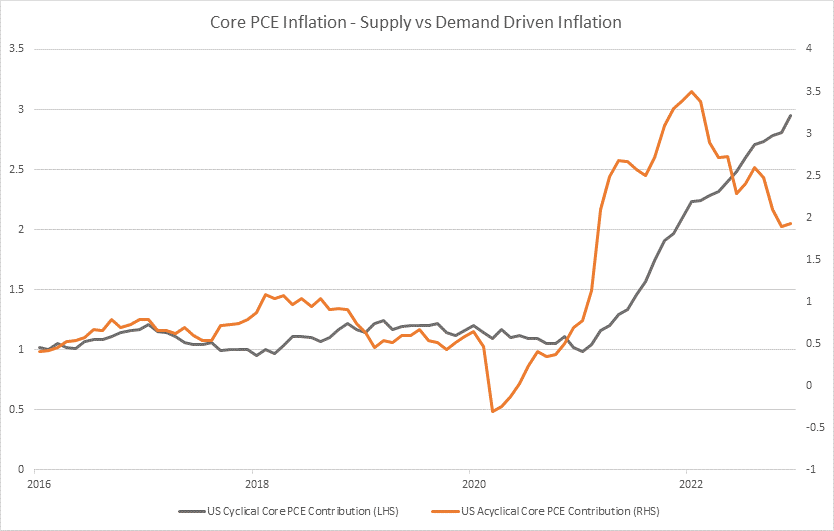

Figure 1 : Alpine Macro Research highlights the argument that disinflation so far has had nothing to do with Fed tightening and the average time between commencement of monetary tightening and a cyclical peak in inflation is about two and a half years.

Source: San Francisco Federal Reserve, SG Hiscock & Company

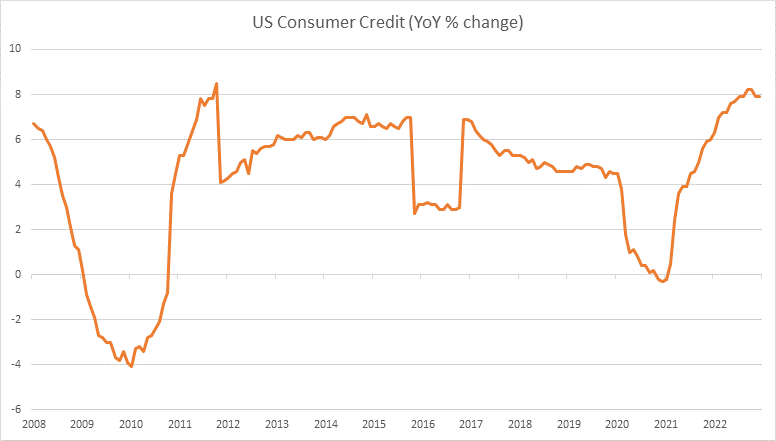

Figure 2: Consumer spending – which accounts for just under 70% of US nominal GDP – has been driven by pandemic related excess savings along with recent credit growth.

Source: US Federal Reserve, SG Hiscock & Company

Source: US Federal Reserve, SG Hiscock & Company

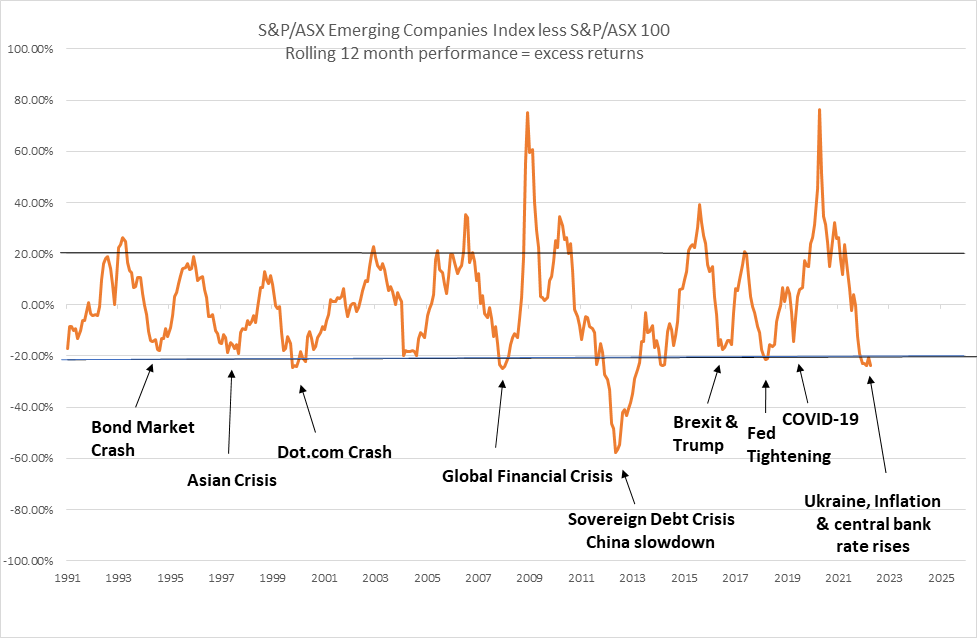

Figure 3: Periods of relative outperformance in emerging companies have come during rate cut cycles

Source: SG Hiscock & Company, Iress

In conclusion, it is our view that the ensuing regional banking crisis in the US has brought forward the terminal Fed funds rate and also expedited the timeline to the first rate cut, via direct and indirect macroeconomic impacts. From a direct perspective, we expect credit growth to significantly slow as regional banks tighten their belts, constraining the velocity of money. From an indirect perspective, undoubtedly until the situation is resolved, there will be an impact on consumer and business confidence which will likely impact spending. All of the aforementioned factors will feed through to aggregate demand, with the quantum of the impact yet to be determined. While this is a net positive for equities via the impact on (cyclical) inflation and the resulting policy implications (rate cuts), it should be noted that too significant a hit to aggregate demand will have a substantial impact on company earning, hence we continue to favour defensive businesses within the portfolios.

Disclaimer

SG Hiscock & Company has prepared this article for general information purposes only. It does not contain investment recommendations nor provide investment advice. Neither SG Hiscock & Company nor its related entities, directors or officers guarantees the performance of or repayment of capital or income invested in the Funds. Past performance is not necessarily indicative of future performance. Professional investment advice can help you determine your tolerance to risk as well as your need to attain a particular return on your investment. We strongly encourage you to obtain detailed professional advice and to read the relevant Product Disclosure Statement and Target Market Determination, if appropriate, in full before making an investment decision.

SG Hiscock & Company publishes information on this platform that, to the best of its knowledge, is current at the time and is not liable for any direct or indirect losses attributable to omissions for the website, information being out of date, inaccurate, incomplete or deficient in any other way. Investors and their advisers should make their own enquiries before making investment decisions.