SGH LaSalle Concentrated Global Property Fund – September Quarter Update

September quarter 2024, Matt Sgrizzi

Global REIT markets and Fund performance*

The global REIT market rallied sharply, up nearly 14% last quarter, and outperformed equities as inflation and economic growth continued to moderate. This performance is consistent with our expectations that inflation fears being overblown, and that the REIT market being under-owned.

Our fund, SGH LaSalle Concentrated Global Property, performed strongly in this rally, outperforming by about 250 basis points and up over 16% in the quarter. That brings our trailing one-year return to an excellent 32.5% for the fund – nearly 700 basis points better than the GREIT Index.

Since we began this strategy, which happens to be exactly five years ago this month, we have outperformed the Global REIT Index by 730 basis points annually, which is an excellent achievement.

How is the portfolio positioned?

The portfolio is only positioned to invest in only the best real estate opportunities we see globally.

Lately, this has spanned a broad mix of real estate investment companies, with some of our largest overweight positions in non-traditional property types like cell towers, billboards, cold storage, triple-net lease properties, data centres, and even single-family homes.

These sectors give investors the key benefits of real estate ownership with differentiated and structurally attractive growth profiles, and attractive risk-adjusted returns. We also have meaningful exposure to REITs in traditional property types, including apartments, daily-use retail, logistics sheds, and even the unloved office sector.

Many REITs in these sectors are poised to benefit from what is likely to be very favourable supply setup, as development has been curtailed in these core sectors. As demand is expected to remain stable, they are likely to enjoy favourable fundamentals.

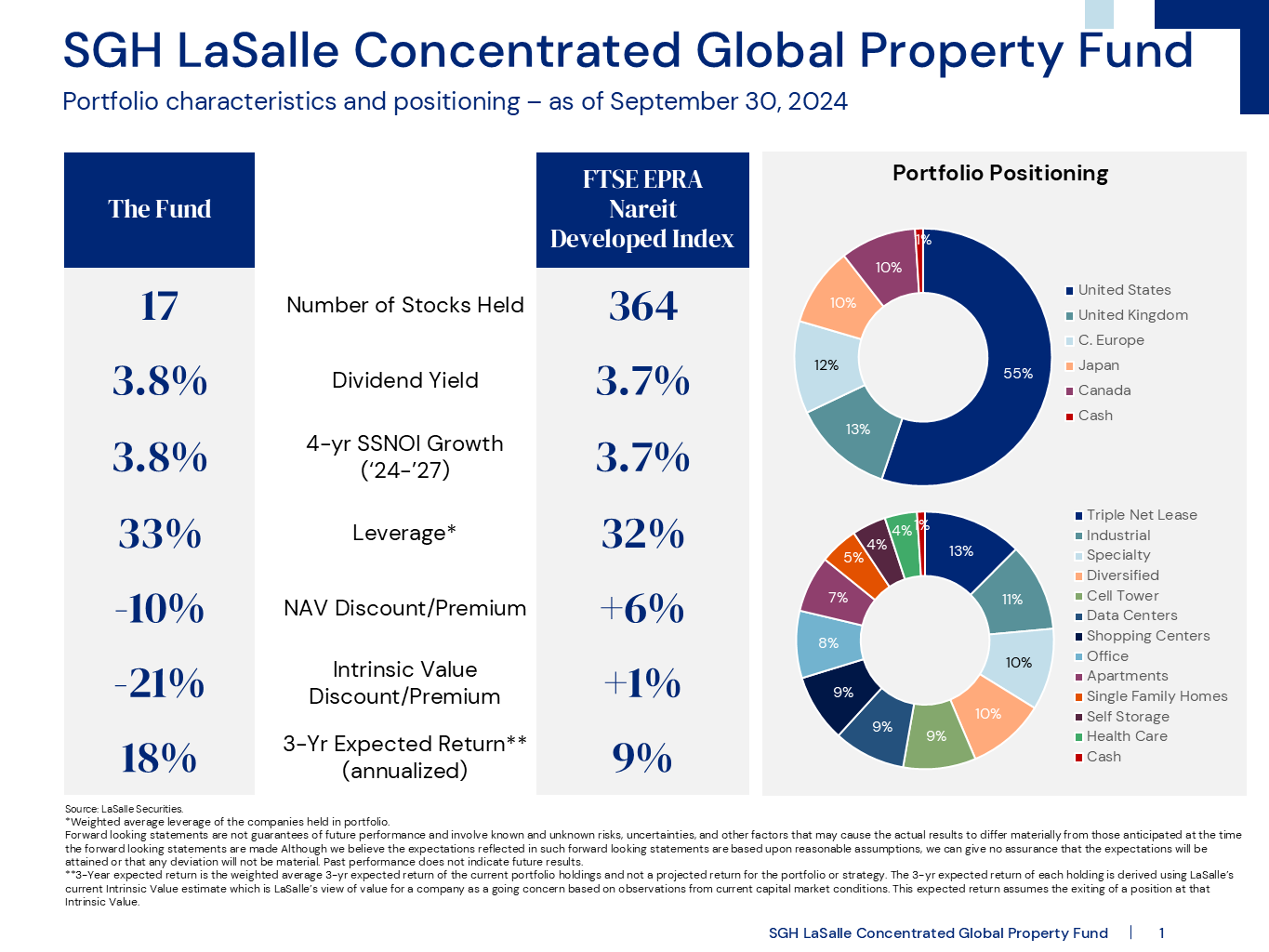

To show you some high-level information in our portfolio positioning today, today you can see we hold just about 17 stocks in the portfolio with an attractive dividend yield of 3.8%.

Very strong forecasted growth of the same 3.8% per year for the next four years in unlevered operating income. Modest leverage remains at a 33% loan-to-value (LTV) ratio.

A significant discount to private markets values or NAV (Net Asset Value) of 10% discount and an even larger discount to our primary valuation metric – intrinsic value – of 21%, which is derived from our capital market-based discounted cash flow model that values REITs as companies.

We underwrite an attractive 18% annualised return for this portfolio on a three-year hold, reflecting the high in-place yields and growth of the companies in the portfolio.

Also note that especially on our key valuation metrics of intrinsic value and expected return, the portfolio was far more attractive than the universe of GREITs represented by the FTSE Real Estate index in the middle of the page.

On the right, you can see that 55% of our portfolio is invested in the U.S., with the U.K. as the next largest real estate exposure, and we have a very good diversification across unique property sectors as you can see at the bottom right.

New positions during the quarter

We changed preference for a holding within the triple-net lease sector, moving to a higher-yield player after our very high-quality holding in the sector performed very well.

We added two new positions in the portfolio during the quarter.

The first one, a Spanish REIT that is taking advantage of a data centre development opportunity within its owned land portfolio. With an ample renewable energy and a direct connection to some of the highest-traffic fibre optic cables in the world, Spain is emerging as a data centre hotspot.

The other company we added is a Canadian healthcare REIT that poised to consolidate the very attractive seniors housing market, which is enjoying some of the best fundamentals in the world as demand recovers, supply remains low, and operating cost pressures fade.

Outlook

First, the dynamic that has driven strong returns for G-REITs lately is set to continue. REITs are under-owned and trade at undemanding valuation levels compared to equities.

The disinflation dynamic we see playing out will underpin a central bank easing cycle, which will be a cherry on top for the attractive outlook for returns from GREITs.

Second, the outlook for real estate fundamentals is solid, underpinned by several dynamic real estate sectors that are enjoying strong pricing power and limited or declining levels of competitive supply.

REITs are also in very strong capital positions and poised to grow their market share compared to private investors who are more dependent on bank financing. We’re seeing this activity really pick up here in the U.S. recently.

Click here to find out more about the fund.

*The text has been edited for clarity.

The document contains general information only. Reference to either individual securities or other investments should not be considered as investment advice. We strongly encourage you to obtain professional advice before making an investment in securities that have been mentioned. Documents you should consider prior to making an investment could include the relevant Product Disclosure Statement and the accompanying Target Market Determination. If you would like further information on financial products that SG Hiscock & Company Ltd (AFSL 240679) is the investment manager for, contact the Client Services team on 1300 133 451, visit the website www.sghiscock.com.au or contact your financial adviser. Any investment is subject to risk, including possible loss of income or capital invested.