SGH LaSalle Concentrated Global Property Fund – Quarterly Update

December quarter 2023

What were the key drivers for the portfolio in the December quarter?

Markets were volatile in the December quarter, but finished on a very strong note, rallying sharply as inflation moderated and the US Federal Reserve signalled rate cuts.

These developments eased financial conditions and very much bring an economic softening into focus.

Global REITs were among the outperformers in the quarter, really benefiting from the change in sentiment and decline in interest rates. GREITs were up 13% and behaved risk on with economically sensitive REITs and REITs in Europe especially outperformed.

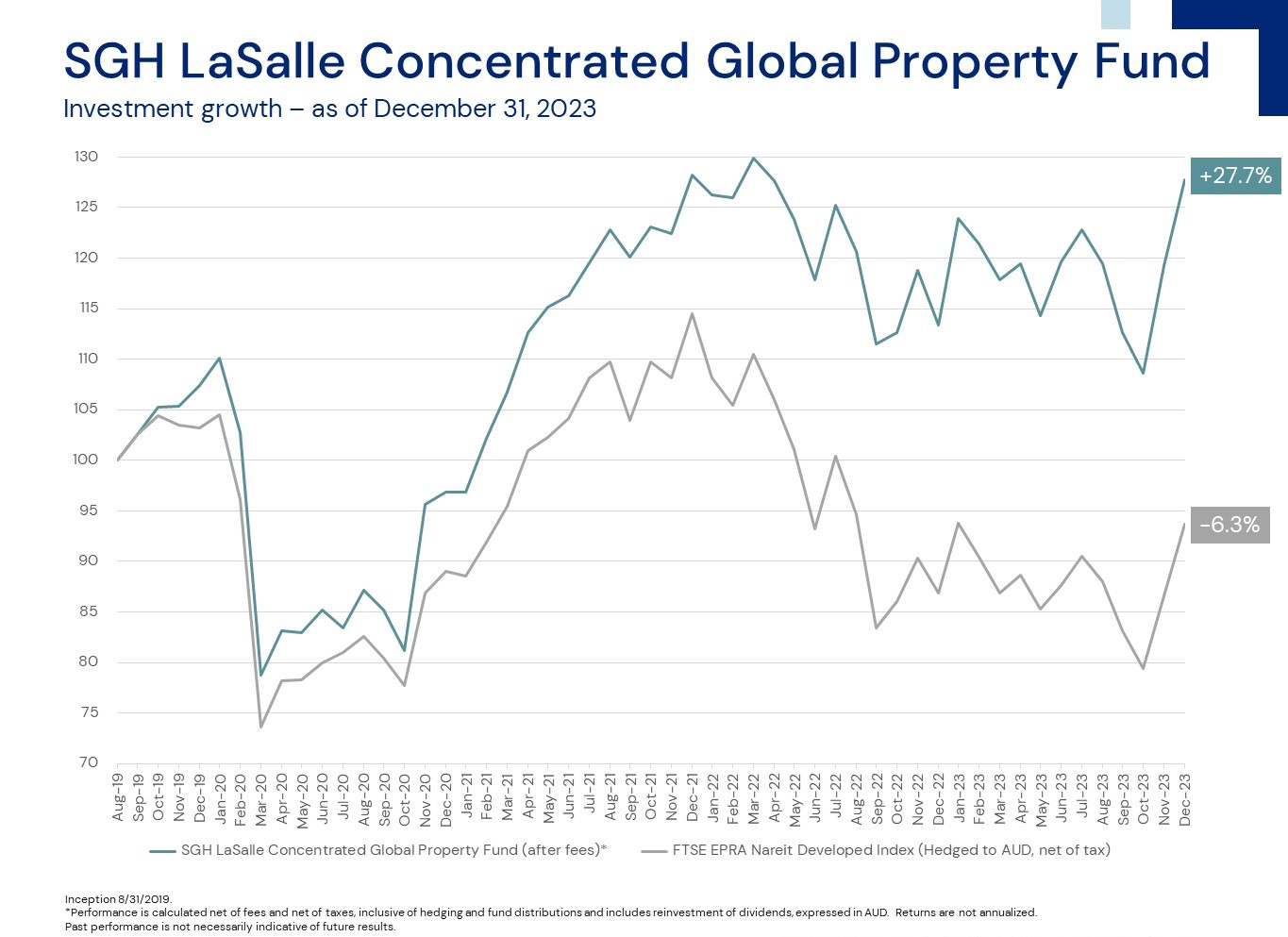

Our fund, SGH LaSalle Concentrated Global Property Fund, outperformed nicely as well, outpacing the index by 70 basis points for the quarter. This brings the full year performance for the fund to a very attractive 12.7%, outpacing the index by 480 basis points. Since we began the strategy four years ago, we have outperformed the index by 730 basis points annually. That’s a really an excellent achievement.

How is the portfolio positioned?

The portfolio is only positioned to invest in the best real estate opportunities we see globally. Lately that’s been a mix of real estate investment companies with some of our largest positions in the core property types of industrial, retail and residential.

These sectors give investors the key benefits of real estate ownership, with attractive levels of income and inflation protection prospects. Many REITs in these sectors are poised to benefit from what will be a favourable supply setup.

Development has been really curtailed in these core sectors the past two years as builders have been scared off by higher interest rates. But as demand is expected to remain stable to strong in these sectors, they will likely enjoy favourable fundamentals.

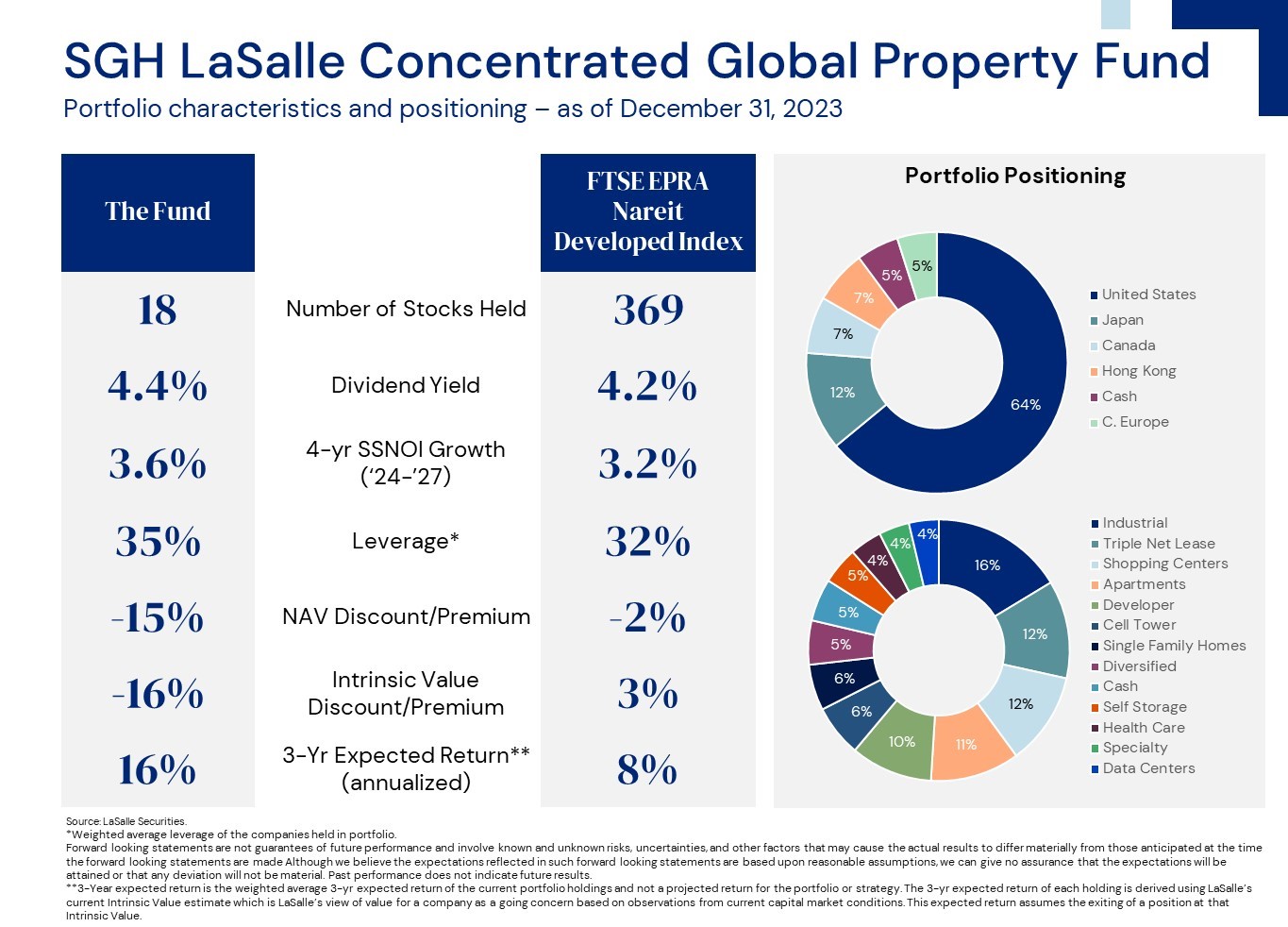

Finally, to show some high-level information on our portfolio positioning, today you can see from the slide below:

- We hold 18 stocks in the portfolio.

- Attractive dividend yield of 4.4%.

- Very strong forecasted growth is at 3.6% per year for the next four years for unlevered operating income.

- Modest leverage levels in the portfolio of 35%.

- Significant discount to private market values or NAV of 15%.

- Healthy discount to our primary valuation metric, intrinsic value of 16%, derived from capital market based discounted cash flow model that values these REITs as going concerns.

- We underwrite to attractive 16% annualised return for this portfolio on a three year hold as well, reflecting the high in place yields and growth for the companies in the portfolio.

Please note that especially our key valuation metrics of intrinsic value and expected return, the portfolio is far more attractive than the universe of GREITs represented by the FTSE Real estate Index.

64% of the portfolio is invested in the US with Japan the next largest real estate exposure at 12%.

Finally, industrial and retail REITs specifically triple net lease and daily use grocery anchored shopping centres make up about 40% of the portfolio and there’s otherwise very good diversification across unique property sectors in the fund.

How has the positioning changed during the quarter?

During the December quarter we changed our preference for holdings in the Life Science Office sector.

This is a sector that has enjoyed much better demand characteristics than traditional office but is suffering from higher supply. After these REITs meaningfully underperformed earlier in the year, we got back into the life science sector and benefited strongly from the position, and moved into another peer in the sector that has that has lagged more recently.

We also reduced our position in the apartment sector, which outperformed strongly earlier in the quarter.

Why should investors look into the fund now?

A very important reason is that even after the December quarter rally, GREITs have repriced since the market peak at the end of 2021 and listed real estate is priced much more fairly in the public market than in the private.

We would continue to say unequivocally that any investor looking to allocate capital to alternatives should do so in the public markets before thinking about the private markets.

Second, the global economy is slowing. Real estate is a highly durable asset class, and this is a time to appreciate that durability. Slowdowns that could more dramatically impact the bottom line of a cyclical or low profitability business, could be an opportunity for well capitalised owners of cash flow real estate.

Third, the track record for this fund has been very strong.

As you can see on the chart here, we have proven our ability to outperform in up and down markets, over really challenging time periods, with an unrelenting focus of only investing in the best opportunities we see in the global real estate markets.

We expect to continue to provide proof that we can help investors navigate the global markets while retaining the many benefits of including liquid real estate in their portfolios.

Click here to find out more about the fund.

The text has been edited for clarity.

The document contains general information only. Reference to either individual securities or other investments should not be considered as investment advice. We strongly encourage you to obtain professional advice before making an investment in securities that have been mentioned. Documents you should consider prior to making an investment could include the relevant Product Disclosure Statement and the accompanying Target Market Determination. If you would like further information on financial products that SG Hiscock & Company Ltd (AFSL 240679) is the investment manager for, contact the Client Services team on 1300 133 451, visit the website www.sghiscock.com.au or contact your financial adviser. Any investment is subject to risk, including possible loss of income or capital invested.