Rob Hogg: Rate cut expectations sharply reduced

Expectations for near-term official interest rate cuts were sharply reduced during the month as Australian and global growth and inflation continue their surprisingly resilient pattern.

Equity market performances in April were generally in the opposite direction to those recorded in March with returns across global equity markets negative in April, as many countries’ share market indices retreated from the record highs they had reached in March.

Global bond yields moved significantly higher over the month, with yield curves moving higher in a near-parallel fashion. In the midst of these sizeable moves in equity and bond markets, the Australian dollar was again relatively little changed. Key market movements over the month were as follows:

- S&P/ASX300 Accumulation Index (i.e., including dividends) fell 2.9%.

- S&P/ASX Small Ordinaries (Australian Small Companies) Accumulation Index fell 3.1%.

- US equity market (S&P500) fell 4.2%.

- Australian 10-year bond yield rose from 3.965% to 4.425%.

- The US 10 bond yield also rose, moving up from 4.20% to 4.68%.

US data still demonstrates resilience

With only a few exceptions, economic data released in April revealed that most developed countries continued to exhibit signs of ongoing resilience in economic growth and inflation.

This resilience, particularly for inflation, was the key cause of the moves higher in market interest rates over the month. These moves in bond markets were a key contributor to equity market weakness as investors recalibrated their expectations for future central bank policy actions.

Earlier in the year market participants were anticipating at least six US official rate cuts this calendar year, as at the end of April this had diminished to less than two.

The US Federal Reserve remains focussed on labour market and inflation dynamics in weighing its next move in the key Federal Funds Rate (FFR). Updates to these indicators in April continued to point to ongoing momentum in the economy:

- The number of new non-farm payrolls totalled a stronger-than-expected 303,000 in March while the unemployment rate was little changed at 3.8%.

- The number of people filing for unemployment benefits on a weekly basis remains low at 207,000.

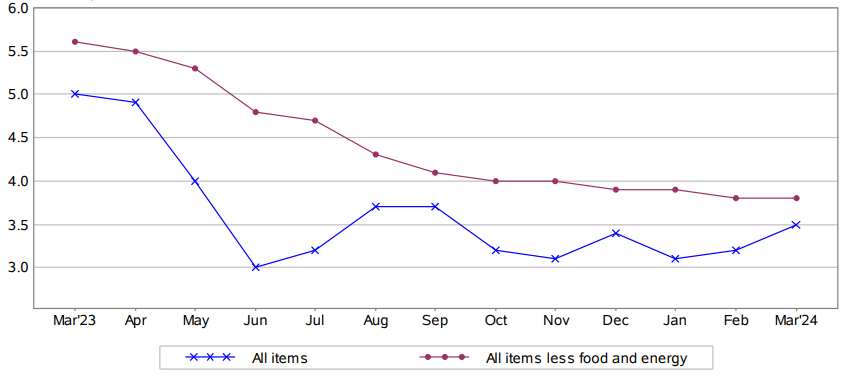

- The monthly rate of inflation upwardly surprised in March, increasing 0.4% following a similar increase in February. More importantly, “core” inflation (excluding food and energy costs) also rose by 0.4% (as it did in each of the two preceding months).

These higher-than-expected monthly changes have caused the headline rate of inflation to begin rising again when measured compared with the same month a year ago (to 3.5%), and have caused the heretofore decelerating rate of annual growth in the core inflation index to settle at around 3.8%.

Annual rate of change in US consumer prices (%)

Source: US Department of Labor, Bureau of Labor Statistics, CPI Release, 10 April 2024, link

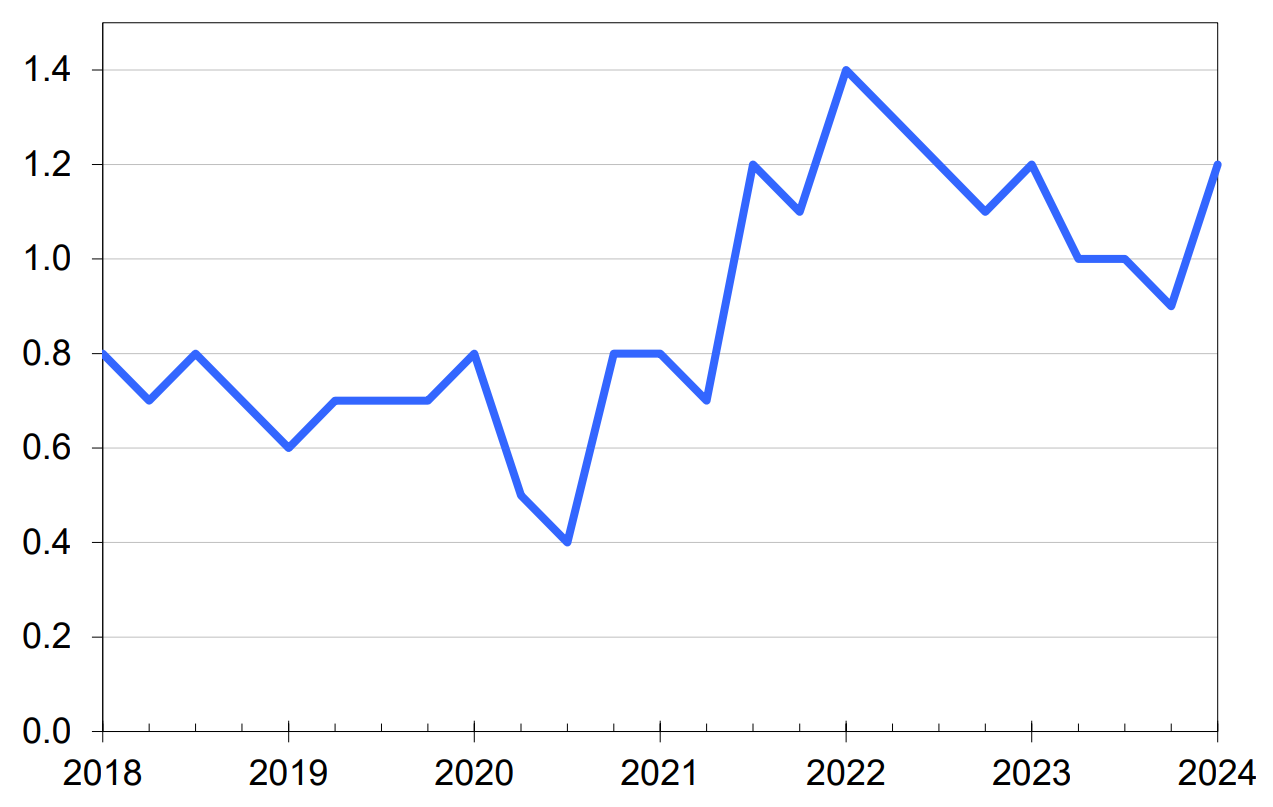

The markets’ inflation fears were stoked further on the last day of the month with the release of the US Employment Cost Index (ECI). This index measures quarterly changes in compensation costs and surprised on the upside with an increase in compensation costs for civilian workers of 1.2% in the March quarter (4.2% over the year).

Three-month percent change in total compensation of US civilian workers

Source: US Department of Labor, Bureau of Labor Statistics, ECI Release, 30 April 2024, link

The surprising resilience of employment and inflation indicators began to cause members of the Federal Reserve’s monetary policy committee to incrementally change the tone of their public pronouncements (“Fed-speak”) during the month, retreating from previously enunciated expectations for numerous rate cuts this year, with some committee members suggesting a rate cut may not occur at all in 2024.

The tone of the US central Bank’s statement following their May 1 meeting seemed to move in a similar direction with the statement adding a phrase to say that

“In recent months, there has been a lack of further progress toward the Committee’s 2 percent inflation objective.”

However, neither the statement nor the Fed Chair’s press conference following the committee meeting made any mention of the possibility of further rate increases, only potential delays in the timing of any rate cuts.

Reflecting the change in investor sentiment generated by the ongoing robust data and the change in the tone of “Fed-speak”, the implied yield on the December Fed Funds futures contract (which prices investor’s expectations for the official fed funds rate) has moved from around 4.70% at the beginning of the year to around 5.10% as at the end of the month so implying little more than one rate cut before year’s end relative to the current Fed Funds rate at 5.375% (the mid-point of the Fed’s targeted range of 5.25% – 5.50%).

Australia: market revising expectations as well

Employment and inflation indicators released in Australia over the month generally carried a similar message of resiliency, suggesting that the Reserve Bank of Australia (RBA) is unlikely to be able to cut interstates any time soon:

- Pointing to the resiliency of growth in the economy, the March employment report revealed that the labour market remained relatively tight in March even as the unemployment rate rose very slightly to 3.8%.Resiliency in the data is best exhibited by the fact that the unemployment rate has barely risen from its low of 3.5% reached in 2022 and that trend monthly employment growth remains at around 28,500.

- The March quarter Consumer Price Index (CPI) rose by more than expected, increasing by 1.0% in the quarter and by 3.6% annually.More importantly, key underlying inflation measures such as the “trimmed mean” and the “weighted median” remain elevated at annual rates of 4.0% and 4.4% respectively and, although decelerating, are doing so at a very slow pace.

But not all Australian indicators are displaying as much resilience as employment and inflation.

Released on the last day of the month were March retail sales which showed that, after a Taylor Swift inspired boost to sales in February, the value of retail sales fell by 0.4% in March.

The Australian Bureau of Statistics (ABS) highlighted the weak pace of sales, noting that

“Underlying retail turnover has been flat for the past six months and was up only 0.8 per cent compared to March 2023. Outside of the pandemic period and introduction of the GST, this is the weakest growth on record when comparing turnover to the same time in the previous year.”

Notwithstanding the weak retail sales news, interest rate markets in Australia were most impacted over the month by the employment and inflation reports with moves in market interest rates quite significant over the month as expectations for rate cuts were scaled-back, as occurred in the US.

This change in expectations caused the Australian 3-year bond yield to rise by around 0.45%, with the 10-year bond yield moving up by a similar amount.

Other themes and developments during the month included:

- The Japanese Yen (JPY) hit its lowest level in 30-years versus the US dollar (USD) late in the month when the JPY depreciated to more than 160 JPY per USD.

This sell-off seemed to be in response to the Bank of Japan’s (BOJ) meeting in April when the BOJ left interest rates at between 0% to 0.1% and did not include any communication alluding to more rapid rate hikes in the near future.

Markets viewed this as a “dovish pause” in the BOJ’s recently begun tightening cycle and have pressured the JPY lower since then.

The last week of April is the Japanese Golden Week holiday and, with markets more illiquid than normal, it seems authorities opportunistically intervened to attempt to support the currency. The JPY strengthened back to 155 to 156 intraday on the rumoured intervention. - BHP made a bid for Anglo American offering 0.7097 BHP shares for each ordinary share in Anglo American. Market analysts suspect that Anglo’s copper assets are a key motivating factor. Being an unsolicited, non-binding and highly conditional offer, it is not at all clear how this situation will develop.

Looking ahead

It is still likely that evolving investor expectations about future central bank policy actions will be the most important driver of market performances.

Market sentiment has shifted dramatically since the start of the year from a benign outlook (slowing inflation and growth, allowing central banks to cut interest rates so cementing a “soft-landing”) to a less market supportive expected environment of higher-for-longer interest rates as central banks attempt to squeeze inflationary pressures out of the system.

More extreme scenarios, such as stagflation – anaemic growth and ongoing inflation – are at risk of becoming a higher probability if inflation remains resilient and growth slows, with central banks limited in their ability to react in such an environment.

Read Rob’s April update | Watch his March quarter video

Disclaimer: SG Hiscock & Company has prepared this article for general information purposes only. It does not contain investment recommendations nor provide investment advice. Neither SG Hiscock & Company nor its related entities, directors or officers guarantees the performance of, or the repayment of capital or income invested in the Funds. Past performance is not necessarily indicative of future performance. Professional investment advice can help you determine your tolerance to risk as well as your need to attain a particular return on your investment. We strongly encourage you to obtain detailed professional advice and to read the relevant Product Disclosure Statement and Target Market Determination, if appropriate, in full before making an investment decision.

SG Hiscock & Company publishes information on this platform that to the best of its knowledge is current at the time and is not liable for any direct or indirect losses attributable to omissions for the website, information being out of date, inaccurate, incomplete or deficient in any other way. Investors and their advisers should make their own enquiries before making investment decisions.