The CPI had more market impact

Rob Hogg, Chief Investment Officer and Head of SGH Individual Portfolios

Last night in the US two key events occurred – the release of the May Consumer Price Index (CPI) and the latest Federal Open Market Committee (FOMC) announcement. The CPI had more market impact.

A significant downside surprise in the US May Consumer Price Index (CPI) drove equity and bond prices higher overnight, albeit with a mild weakening in bond and share prices occurring later in the trading day after the US central bank’s Federal Open Market Committee (FOMC) decision was released on 13 June 2024 at 4 am (AEST time).

The FOMC announcement was regarded as mildly bearish as the committee revised down its expected number of rate cuts by end year from three to one (the so-called “dot-plots”), while upwardly revising its inflation and long-term interest rate expectations.

Overall, the CPI release had more impact on markets overnight.

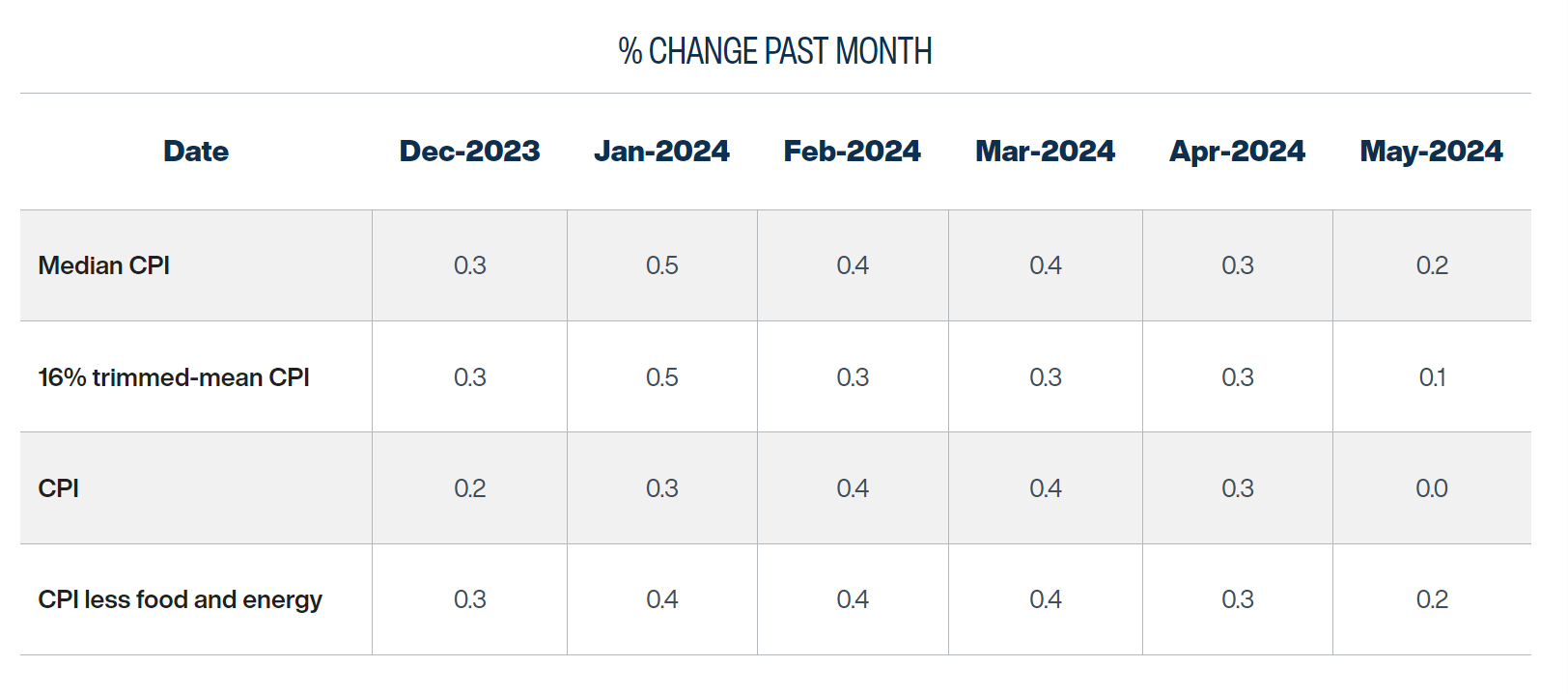

Key was the improvement in underlying measures of inflation, such as those produced by the Federal Reserve Bank of Cleveland that measure “median” and “trimmed mean” inflation. These are measures that give a read on the breadth of inflation, and both suggested an easing in broader inflation pressures in the US economy.

From a monetary policy standpoint, the easing of underlying inflation pressures is extremely positive as it is an easing in inflation that will enable the US Fed to cut rates if economic growth continues to soften.

But these broadening signs of slowing in US growth (which the CPI results are likely reflecting), suggest that investors will need to be on the alert for signs of downside earnings risks which are likely to accompany these moderating growth and inflation trends.

Directly following the release of the CPI, market pricing moved to reflect two expected cuts to the benchmark Federal Funds Rate (FFR) by end year. But this retreated to around 1 ½ cuts following the FOMC announcement later in the trading day.

CPI details

Published at 10.30 pm last night, the May CPI surprised on the downside. Most positively, underlying measures (such as the Cleveland Fed’s median and trimmed mean) eased further. This is an extremely encouraging outcome.

Headline CPI and core CPI hit levels came in below expectations at 0.0% and 0.2% (at 0.16% compared with 0.29% in April), respectively.

- Key downward influences were weaker goods price data (used car sales) and lower energy prices.

- The so-called “Supercore” CPI moved sharply lower (from 0.422% to -0.045%) driven by significant drops in transportation services, other personal services and recreation services inflation.

In annual terms:

- CPI slipped to 3.3% for May from 3.4%

- Core CPI slipped to 3.4% for May from 3.6%

Housing-related costs remain the key upside influence with over-all shelter costs rising 0.4% (as Owners’ Equivalent Rent (OER) and Rent of Primary Residence both rose by 0.4%).

As noted above, underlying measures such as those produced by the Cleveland Federal Reserve were very encouraging with both median and trimmed mean measures easing further in May – see table below:

Source: Federal Reserve Bank of Cleveland

The FOMC announcement

Released at 4 am this morning, the FOMC Policy Statement along with the Summary of Economic Projections (SEP) saw the FOMC:

- reduce their projected number of rate cuts in 2024 from three to one (compared with the two cuts that the market had anticipated).

- adjust its forecast for the year-end core Personal Consumption Expenditure (PCE) deflator from +2.6% to +2.8% (due to unfavourable seasonality in inflation and unfavourable base effects for 2H 2024).

- adjust their long-run projection for the Federal Funds Rate (or R*, the hypothetical neutral rate) from +2.6% to +2.8%.

The key wording change in the FOMC Statement was to acknowledge “modest further progress” toward the 2% inflation objective (instead of noting “a lack of progress”).

Futures markets priced in a full 2.0 cuts to the benchmark FFR by year-end immediately after the CPI release, but after the FOMC Statement, the release of updated growth and inflation forecasts and Fed Chair Powell’s Press Conference, this fell to around 1.5 cuts implied by the time of the December FOMC Meeting.

Read Rob Hogg’s May Market Update here.

Disclaimer: SG Hiscock & Company has prepared this article for general information purposes only. It does not contain investment recommendations nor provide investment advice. Neither SG Hiscock & Company nor its related entities, directors or officers guarantees the performance of, or the repayment of capital or income invested in the Funds. Past performance is not necessarily indicative of future performance. Professional investment advice can help you determine your tolerance to risk as well as your need to attain a particular return on your investment. We strongly encourage you to obtain detailed professional advice and to read the relevant Product Disclosure Statement and Target Market Determination, if appropriate, in full before making an investment decision.

SG Hiscock & Company publishes information on this platform that to the best of its knowledge is current at the time and is not liable for any direct or indirect losses attributable to omissions for the website, information being out of date, inaccurate, incomplete or deficient in any other way. Investors and their advisers should make their own enquiries before making investment decisions.